NamasteTrump

Table of Contents

- On February 24/25, 2020 President Trump will visit India. This could be an “India Reset”, diplomacy that reshapes geopolitics and finance, trade, defense. Or it may not.

- India is the world’s largest beneficiary of the preferential trade treatment.

- Section 1: What does Trump and the U.S want

- Section 2: What does India want?

- Section 3: India’s odd trade imbalance with China

- Section 3: Defense

- Section 4. Make America Great Again meets Make India Great Again

On February 24/25, 2020 President Trump will visit India. This could be an “India Reset”, diplomacy that reshapes geopolitics and finance, trade, defense. Or it may not.

Both are transactional leaders, both need a deal.

Let’s begin

“There will be five to seven million people just from the airport to the new stadium” Trump

Background

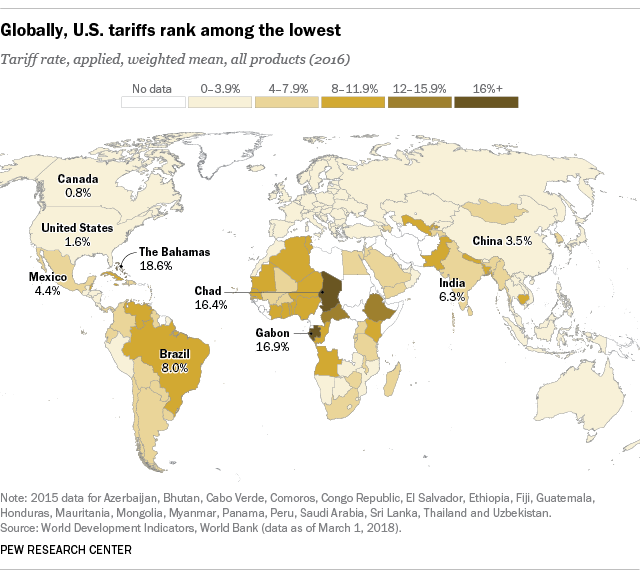

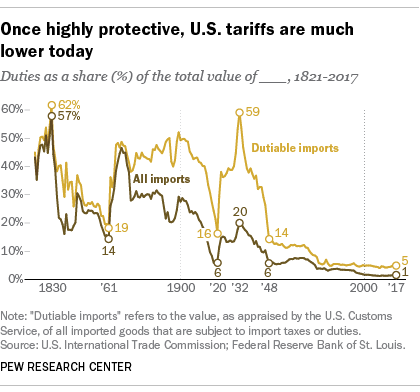

U.S. tariffs are among the lowest in the world and in the nation’s history. We have “free trade”, few and low barriers, other countries don’t. It’s asymmetrical.

Mercenary pundits and experts are diffusing the propaganda of our enriched trading partners, they authoritatively recite trade disasters in America’s distant past. Reality is quite different…

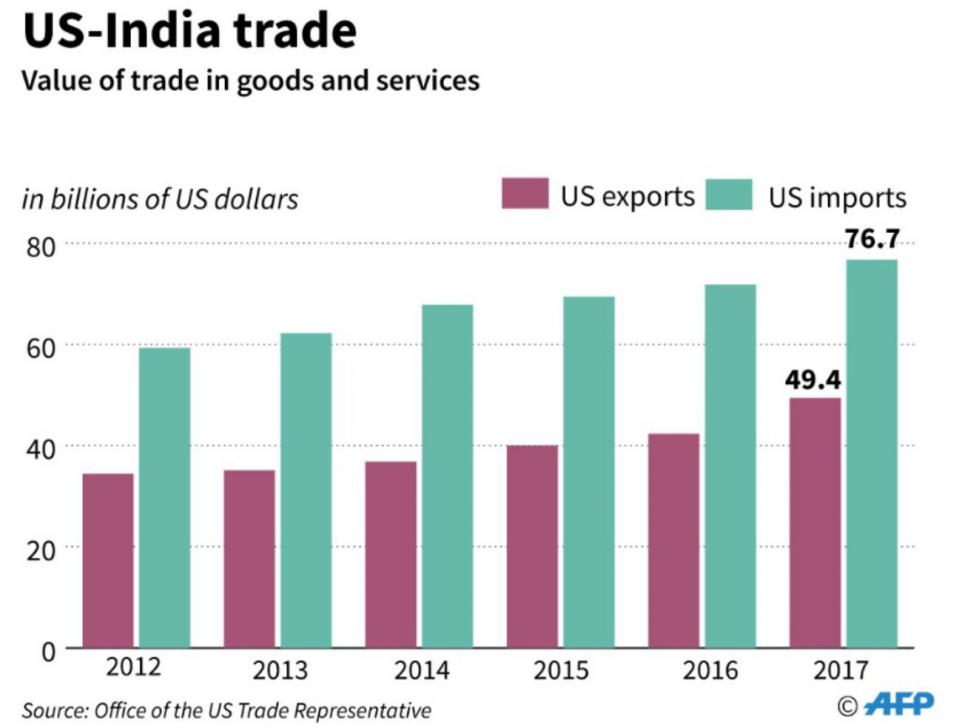

In 2017, when Trump entered office our trade imbalance with India was disastrous. Trump called them the “Tariff King”

In 2018-19

- India’s exports to the US was $52b, imports were $35b

- Trade deficit dropped from $21b in 2017-18 to $17b in 2018-19, due to India’s purchase of oil, natural gas and coal. A bigly and neglected benefit of Trump’s energy policies.

In 2019, the Trump administration directed a rules change in global trade to remedy a cheat, nearly two-thirds of WTO members have been receiving special treatment by designating themselves as “developing” countries. An honor method that corresponded with loose and unenforced metrics.

Trump terminated the preferential trading status of $5.6 billion of Indian exports under its Generalized System of Preferences (GSP), a program benefiting “developing” economies.

India is the world’s largest beneficiary of the preferential trade treatment.

One qualification of the program that India failed is “equitable and reasonable” access to their markets for U.S. goods and services. This largely hit India’s farm, marine and handicraft products and introduced about $200m in new costs.

In early 2020, weeks before his visit, Trump removed India from its list of ‘developing countries’ exempted from Section 301 investigations into whether they harm American industry with unfairly subsidized exports.

Section 1: What does Trump and the U.S want

Abbreviated: the American side wants the removal of price caps (Trade Margin Rationalization) for its agriculture, dairy products and to remove the 20% tariffs on Information and Communications Technologies (ICT) products.

Case by case:

ICT. The US has said that it exports of these goods to India were valued at about $500m in 2018 and that despite India’s legally binding commitment in the WTO not to charge any duties on these products, India has been applying duties ranging from 7.5% to 20%. The U.S industry has also been regulated out of India’s markets by high barriers such as procedures related to issues like telecom testing, conformity assessment, etc.

Automotive products. India imposes 50% tariffs on motorcycles, automobiles are 60%

Alcoholic beverages have a 150% tariff

Dairy: U.S has been constrained from selling its dairy products because India requires that dairy products are “derived from a dairy cow that has been fed a vegetarian diet for its entire life.” India defends its position on religious and cultural grounds, whereas the International Dairy Foods Association calls these requirements “scientifically unwarranted.”. India has agreed, but not implemented a simplified dairy certification procedure that was sought by the US, this would not dilute India’s religious requirement.

Medical equipment has been an issue for years as India has imposed large customs duties on medical equipment and devices.

Poultry. India’s chicken consumption is largely imported chicken legs, but India banned the product in 2007 citing a precaution against avian influenza. American poultry producers are stuck as the domestic market prefers chicken breast, creating a problem of surplus

Digital Economy.

Many U.S. companies have back-office operations in India, platforms with half a billion internet users and generating enormous data flows. Modi has called it “new oil” and want to capture the value from the data and has imposed large and expensive regulatory and compliance costs for American companies

Section 2: What does India want?

(The list is short, this is because we don’t have the high tariffs, barriers to entry and absurd regulatory regime of India)

Information and Communications Technologies: India fears that eliminating tariffs on ICT products invites Chinese companies to come in and flood their markets.

Generalized System of Preferences (GSP) program resumed

Agricultural products

- Easier access to US markets for the export of mangoes, grapes, pomegranates, etc

- Facilitation of processes in agricultural product markets where it already had access

- Easier certification of food product irradiation facilities

Relief from duties on certain steel and aluminum products, a painful hit as India urgently needs foreign companies to bring in capital and high-end technologies to build out its infrastructure.

Visas in Services Trade

- Indian government considers the “movement of natural persons,” or procedures typically involving a visa regime as a “services” trade.

- For the United States, these are immigration matters that cannot be negotiated in trade deliberations

Section 3: India’s odd trade imbalance with China

- India-China bilateral trade was $84b in 2017, India’s deficit was $52b

- In FY18, exports to China had risen 31% to $13b while imports were up just 24% at $76b, which increased the trade deficit to $63 billion.

Then something strange happened.

The commerce ministry announced in late 2019 that the trade deficit with China came down by $10b in the fiscal year ended March 2019 to $53b.

Live Mint, an Indian publication, did an analysis and China that proved that China is using Hong Kong to camouflage the real size of its surplus in trade with India. Their numbers show that during the same period, there was a sharp rise in exports to Hong Kong, a special administrative region run under the “one-country, two-systems” mechanism.

China has begun to ship some of its products through Hong Kong, rather than its domestic ports. The combined Indian trade deficit with China plus Hong Kong has not budged.

Example of this scheme:

- India’s imports of mobile phone spare parts from China fell by 34% in 2018

- The import of the same product from Hong Kong jumped by 728% during the same period.

Section 3: Defense

During Obama’s administration, the U.S Defense industry was largely denied India as a client on the odd grounds they it would alter the balance of power with Pakistan. India increased its purchases and dependence on Russian made equipment, technology and services. One example of how this has hur U.S interests is India competed its purchase of the S-400, an air defense system that had begun negotiation in 2015.

Since 2017, Trump has offered India armed drones, integrated air, missile defence, and the sale of ‘sensitive technology’…

Air defense systems

The State Department in February 2020 approved a possible Foreign Military Sale to India of an Integrated Air Defense Weapon System (IADWS) for an estimated cost of $1.9b

Helicopters

During the Trump visit, India and the US are likely to take forward their deals on the acquisition of 24 multirole helicopters for the Indian Navy and six Apache attack choppers for the Indian Army

- In 2019, India signed a $3b contract with Boeing for the purchase of 22 AH 64E BlockII Apache attack and 15 CH-47F Chinook heavy-lift helicopters

- India recently announced the purchase of 24 multi-role helicopters, MH-60R Seahawks for $2.5 billion.

Planes

- Boeing is offering its F-15EX fighter jets to the Indian Air Force and has sought a licence from the US authorities for its possible export to India. This would likely lock up an $18 billion contract by Indian Air Force to procure 114 fighter jets, Boeing’s F/A 18 Block III Super Hornet is already in contention for the deal.

- Boeing is also eyeing Indian Navy’s plan to procure 57 carrier-borne aircraft.

Navy

In 2019, The US has approved the sale of 13 naval guns and related equipment worth $1 billion to India

Section 4. Make America Great Again meets Make India Great Again

Energy:

- India, as an energy consumer since 2017 has begun strongly diversifying its energy imports from Iran and Saudi Arabia, and increasing its portfolio of US energy imports.

- India needs next generation nuclear energy and the infrastructure to support it, something they had plotted for with Westinghouse but fell part, increasing their need for coal. with Trump administration approval Westinghouse can still supply, will they?

Medical devices Permit American manufacturers of medical devices to establish manufacturing facilities in India and remove pricing controls (a careful balancing act)

Digital

- India has avoided giving and precision to its proposed digital/date governance regime.

GSP.

- An agri deal could help restore some of India’s GSP benefits and also save American companies close to $250 million.

- The U.S. could graduate India back into the GSP

ICT India’s must reduce the tariffs on Information and Communication Technologies’ products. India is concerned that removing these tariffs could open up the market to a flood of Chinese products. India enforcing tighter trade balance with China could remedy this

Trade and American investments into India.

Sino-US tariffs may become the new normal, a syndicate of other countries will take up that slack as the global manufacturing base.

As more foreign investment and technology flow to other nations, China’s chances of becoming a technologically advanced, innovative economy will end, a strategic goal of the U.S. India needs to anchor this.

India might further reform Foreign Direct Investment (FDI) rules. This will also allow India to capture the diversion in investment flows as manufacturers seek alternative origination destinations. U.S. businesses with manufacturing in China and are now looking at Bangladesh, Vietnam and African economies.

A boost to India’s economy:

- The US is looking to replace Chinese exports with Indian products in at least seven U.S product lines including vulcanised rubber, footwear, engineering goods, etc.

- India’s Department of Commerce identified 203 products where exports to the US could be increased by replacing Chinese exports as it already has market access for these items and is a competitor of China.

- Ultimately, the big fish is also producing the world’s pharmaceutical ingredients, a monopoly China holds

More boost to India’s economy

India can help resolve a deception that China is using called “knockdown” – taking apart a product into its components and reassembling them outside China to avoid tariffs and duties. For electronics and associated parts they have utilized Taiwan and Vietnam as those countries are already exporting such goods to the US and have the ability to quickly ramp up assembly.

India is the most desirable swap for China, with an assist its supply chain can be quickly scaled up, made bigger and denser and more efficient than its rivals. Currently, demand is beyond India’s existing capacity.

The End?