Beware the Belt and Road

Table of Contents

China’s Exim Bank

8 countries with Belt and Road bilateral relationships with China along Belt and Road path

if you’re unfamiliar with what the Belt and Road (BRI) is, my explainer here

Djibouti (Africa)

In two years, public external debt increased from 50 to 85 percent of GDP, much of this debt is government-guaranteed public enterprise debt and is owed to China Exim Bank. China has provided nearly $1.4 billion of funding for Djibouti’s major investment projects, equivalent to 75 percent of Djibouti’s GDP. Future projects reportedly include at least two new airports, a new port at Ghoubet, an oil terminal, and toll road.

While a number of Chinese loans have been extended at below-market rates, which will reduce the risk of default, others, such as the financing for the Addis Ababa–Djibouti railway, are reported to be closer to commercial rates.

The Maldives (South Asia)

Prominent investment projects

- Upgrade of the international airport costing around $830 million

- Development of a new population center and bridge near the airport costing around $400 million

- Relocation of the major port (no cost estimate).

China Exim Bank has reportedly announced financing at concessional terms—the airport is reportedly to be repaid in 20 years with a five-year grace period.

Lao People’s Democratic Republic (Southeast Asia) The $6 billion cost for the China-Laos railway is almost half the country’s GDP, and although Lao Ministry of Finance officials stress that the government will not guarantee the vast majority of the financing from China Exim Bank, the Laotian government will be under considerable pressure to cover any losses.

The financial terms for many elements of the project remain a secret, although one source has reported that a $465 million loan from China Exim Bank for the joint company building and operating the railway will be provided at 2.3 percent interest with a five-year grace period and 25-year maturity.

The Laotian government has also reportedly signed a $600 million loan agreement with China Exim Bank for a hydropower project.

Montenegro (Southeast Europe)

Its public debt (including guarantees) as a share of GDP climbed to 83 percent in 2018. The source of the problem is one very large infrastructure project, a motorway linking the port of Bar with Serbia that would integrate the Montenegrin transport network with those of other Balkan countries.

The Montenegro authorities concluded an agreement with China Exim Bank in 2014 for the latter to finance 85 percent of the estimated $1 billion cost for the first phase of the project. The estimated cost has since risen to $1.1 billion, or over 25 percent of GDP. The loan for the first phase of the project will reportedly be extended with an interest rate of 2 percent, five-year grace period, and 20-year repayment period.

The road is being built in three phases, and the IMF believes the second and third parts of the highway should only go forward with highly concessional funds because non-concessional terms would likely result in debt default.

Mongolia (East Asia)

Their economic prosperity depends on large infrastructure investments that will increase productivity and facilitate exports. Financing for these investments will need to be secured on a concessional basis, which has not generally been the case in the past.

The China Exim Bank agreed in early 2017 to provide financing under its $1 billion line of credit at concessional rates for a hydropower project and a highway project from the airport to the capital. However the hydropower project has stalled, and elements of this financing is reportedly being redirected to other projects.

But if reports that Beijing expects to channel some $30 billion in credit to BRI-related projects over the next five to ten years are true, then the prospect of a Mongolia default is extremely high, regardless of the concessional nature of the financing.

Tajikistan (Central Asia)

Is planning to increase its external debt, both at concessional and non-concessional rates, to pay for infrastructure investments in the power and transportation sectors supporting BRI:

- $3 billion portion of the Central Asia-China gas pipeline passes through Tajikistan,

reportedly financed through Chinese foreign direct investment (FDI), although there could

be pressure for the Tajik government to cover some of the financing costs. There are

conflicting reports on whether this project has stalled - Tajikistan issued $500 million in Eurobonds to pay for a new hydropower generating facility. Debt to China, Tajikistan’s single largest creditor, accounts for almost 80 percent of the total increase in Tajikistan’s external debt over the 2007-2016 period.

Kyrgyz Republic (Central Asia)

China’s Exim Bank is the largest single creditor, with reported loans by the end of 2017 totaling $1.5 billion, or roughly 40 percent of the country’s total external debt. Kyrgyz and Chinese authorities are reportedly discussing

- the construction of a chain of hydropower plants

- China-Kyrgyzstan-Uzbekistan railway

- additional highway construction

- Completion of the Central Asia-China gas pipeline.

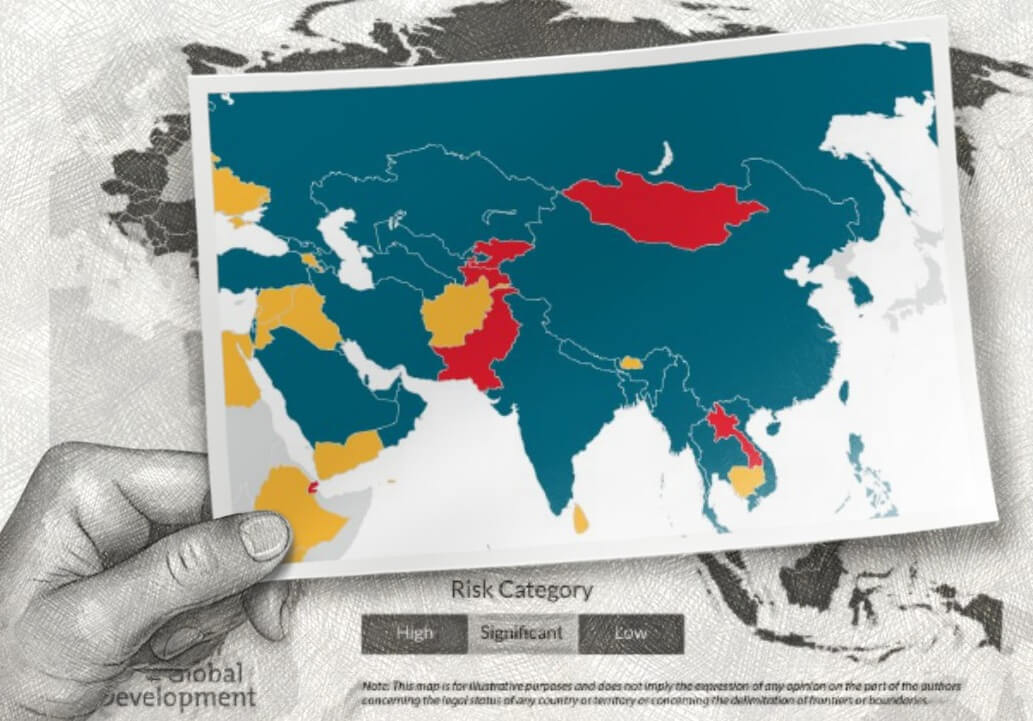

23 more Belt and Road countries

…all rated below investment grade

From data gleaned from a debt sustainability analyses and removing the “not rated” countries that are at a lower risk of immediate debt distress

- East and Southeast Asia: Cambodia, Mongolia, and Laos

- Central and South Asia: Afghanistan, Bhutan, Kyrgyzstan, Maldives, Pakistan, Sri

Lanka, and Tajikistan - Middle East and Africa: Djibouti, Egypt, Ethiopia, Iraq, Jordan, Kenya, and

Lebanon;

Europe and Eurasia: Albania, Armenia, Belarus, Bosnia and Herzegovina, Montenegro, and Ukraine.

End?