Zenefits.

I have been skeptical of Zenefits for a long time. I have written posts in plain language and also in medieval, hidden meanings buried in between words.

Scene 1. Act one. Stage left: Ghost of Professional Services past. He is of average height, overweight and balding. He is wearing a velour shirt that is open and a gold necklace.

In 2002 Insperity was enormously profitable. By the end of that year they were almost out of business.

The stock had gone from $30 to $2 within a year. At that price nobody bought out the company and nobody tried.

The mechanisms of Insperity were broken.

- Insperity at that time had about 8000 clients, 100,000 worksite employees, 150000 ppl on their medical plans.

- Insperity was in a lawsuit with their medical provider, Aetna.

- Both the medical and the worker comp books had blown up (thats bad)

- They had about 75 million cash in the bank.

- They charged clients a concealed fee called ‘reserve’ as a rainy day fund.

Insperity recovered. I was there and I watched from each department.

The stock went from 2 to almost $60 within two years.

Scene two, act two: Enter from left the ghost of Professional Service Present. He is wearing an argyle sweater, aviator sunglasses are crooked.

Zenefits was a great business until it wasn’t.

Technology

Zenefits built a frictionless doorway for prospects to gain information, get a proposal and evaluate, convert to clients and self onboard.

When technology breaks down, and it will either from client garbage in/garbage out errors or from glitches on the Zenefits side, the forensics are expensive and repair is costly and disruptive.

Where will the clients come from

Zenefits started in the early days of the ‘rush to knock down the market leaders’ but they made tactical mistakes, they should have bought there way to a premium. Now, short tech history later there are just no more big books of high quality business to buy so their growth has to be generated (mostly) organically.

The economics of buying clients vs organic acquisition depends on your outlook of the market. I’m bullish and I think you should buy whats goof and available.

One of the greatest problem for Zenefits is their sequence was right for a software SaaS but wrong for a Professional Services Business. They built the moustrap but the mouse will likely escape and find itself more ‘non lethal’ bait.

Sales

Brute force works tactically in situational play. It is an effective strategy in several different scenarios but none should apply to Zenefits.

- In a recession when you want to get as many looks at prospects as you can and you possess the mechanisms to extract value.

- Company is willing to forgive client quality and pricing discipline.

- New entrant in a new industry.

- Profitable product/service and needs more

Sales brute force can create unwanted volatility. Sales commissions are a form of profit distribution, if a company is not profitable salespeople earnings will be meager. Sales turnover is bad, tenured reps leave and join the competition. They take clients.

Sustainability

Professional Services companies must be profitable. Earnings are not exponential or geometric, they are 6th grade algebra.

I think their plan was to get public and leave the problem fixin’ to the next generation of managers.

Professional Services startups must expect to operate what they build.

Benefits

Their client profile is tech companies. The tech companies all have a young population. The younger population will quickly migrate to the state exchanges. What will likely remain is a book of adverse selection, the people who can’t get insurance elsewhere

As the carriers need to improve their own earnings they will squeeze their front end pieces like Zenefits.

You can argue that Zenefits can pass rate increases onto their clients.

But they can’t.

And the clients know it. They have their own vendor management logic. If they walk so does a piece of Zenefits expensive branding.

Act 3, scene 3 Enter Ghost of Professional Services future. He is dressed from head to toe in tinfoil. Head is totally bald, no eyebrows and his eyes are concealed behind an Oculus rift.

Professional services companies are tricky to acquire because you aren’t sure what clients will stick, if there is really a secret sauce in the operations or if its being run on fumes and you dont know the quality of the book of business and what margins can be improved. There is also a human element that is always unpredictable.

- Everybody loves to put themselves in league with their preffered market segment leader. “We are a threat to ABC””ABC will buy us””we are in talks right now with ABC”ABC is afraid of us”

- ABC isn’t buying. Their time tested M.O is to accept every invitation to the dance and then spend months doing due dilligence, sometimes paying a small fee for the privilege. Once they have exhausted you, they walk away.

- Market leaders are not threatened by a lower cost alternative. They know that one of the levers they have is to lower their prices and that can neutralize the opponent’s biggest advantage.

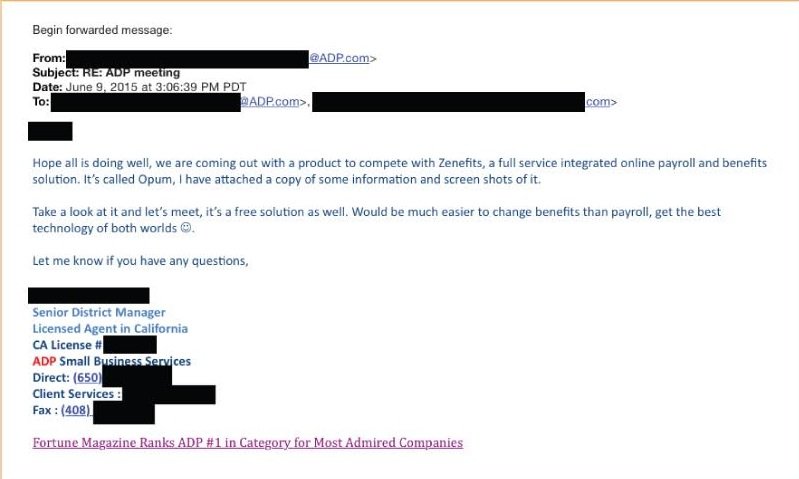

Now ADP has declared war on Zenefits. They have come out with an identical product. Zenefits has fired back.

Zenefits loses a war of attrition.

- ADP is a perpetual motion machine. They flood the streets with payroll reps, get looks into everything under the sun and then pass the lead, client or referral into the appropriate ancillary ADP sales channel.

- Zenefits isnt profitable. Every nickel in its coffers has servicing expenses.

- Zenefits will lose in the public eye. ADP is the safe market leader. Zenefits is not.

- Zenefits has no tolerance for holding risk.

- And then comes the hard part, how to build a profitable company on a low margin, human capital intensive, complex sale when you don’t have the levers.

And, with or without Zenefits this prediction of the short term: There will be rapid fire M &A and a de-fragmentation of the market. Capacity will be taken out and proftability of the industry will be restored

Lessons learned.

- Take all opponents seriously, don’t be arrogant.

- Clients react very badly to adverse headlines.

- The best clients leave first.

- When you make a mistake, sometimes its exponentially bad.

“Let’s get down to brass tacks. How much for the ape?”- Fear and Loathing in Las Vegas