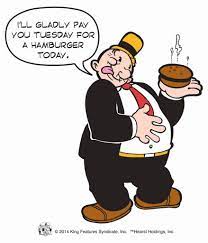

Venture Capital Burgers given today, will be paid for tomorrow

J. Wellington Wimpy desires a burger and he appeals to a merchant to allow him to postpone payment to a later date.

We surmise from Wimpy’s appearance that he is not suffering from starvation, although possible malnutrition.

Burgers eaten today can be very expensive

Venture Capital has been a cyclical industry. We are in the ‘good times’ and I expect this will be an extended, unprecedented cycle.

The industry has benefitted from a historic capital tidal wave. New management teams are eager to jump tech chasms and become early adopters and so on.

The only pieces we have not yet seen blazing forward are CMO ‘like’ packaging of tail end funds.

Seed funds and early stage investors are pricing ‘liftoff’ risk and installing mechanisms to preserve their capital. B round investors are looking for VC backed companies that have been DErisked.

This scenario helps create a funding gap. It is the B round squeeze.

Human intervention in processes is expensive and labor intensive. Entrepreneurs often have too much confidence in their technology, when problems arise this makes the forensics that much more costly.

Achieving operational excellence takes time. It requires proper construction and staffing to get to make the ‘secret sauce’. These are B round problems. It’s when a company has just enough money to hang itself.

Between the A and B round, Entrepreneurs may find themselves in a groundhog day loop of ‘just in time’ financing that will constrain proper short/long range strategy. New rounds may incrementally push the company to unfortunate capitalizations and down rounds.

There is an inventory of deals that will have to work thru purgatory.

This leads to a new generation of lifestyle businesses that were funded, and then clawed back, from early stage investors.

- Is this a lifestyle business? Having a Venture funded company has acquired a social cache, but it may deceive an entrepreneur by appealing to their vanity rather than an economic sensibility

- Is the company better capitalized with debt? Many entrepreneurs are in an echo chamber of lean startup and ‘go big or go home.’ Debt can be forecasted, properly budgeted and serviced. Its not sexy but it allows a business the time to build a sustainable business.

- Must you remain the CEO/Operator? If its certain that you have to be the CEO/operator, consider being a lifestyle business, patiently and profitably growing the company. I have seen extraordinarily large companies, some public, that are lifestyle businesses. 30 years in, they are still in the first generation of management team.