We gotta talk about China and food supply, but first we gotta talk about…

Table of Contents

CFIUS

(Committee on Foreign investment in the US)

CFIUS is made up of 32 different federal agencies that review foreign purchases that could affect U.S. security such as access to technology, military contracts, installations or other sensitive information. Agriculture isn’t part of the CFIUS mandate nor is the USDA or FDA.

The committee isn’t required to review any deals, relying instead on outsiders or other government agencies to raise questions about the appropriateness of a proposed transaction.

The most common foreign investor that hits the CFIUS radar is China. Let’s peel that onion

- President Obama stopped a Chinese investment fund from acquiring the U.S. subsidiary of a German semiconductor manufacturer

- In September 2017, Trump halted a China-backed investor from buying the American semiconductor maker Lattice

- A Chinese company’s plan to acquire the American money transfer company MoneyGram fell apart after CFIUS expressed their concerns that the personal data of millions of Americans would be exposed

- CFIUS advised against a Chinese group’s attempt to buy Xcerra, a Massachusetts HQ’ed tech company

- Trump blocked the purchase of the chipmaker Qualcomm by Singapore-based Broadcom Ltd.on the advice of CFIUS

Now we gotta talk about Chinese pollution

Only (about) 11 percent of Chinese land can be farmed. Most of its tremendous land mass is inarable, degraded by erosion, salinization, acidification, industrial effluent, sewage, excessive farm chemicals and mining runoff.

Chinese rivers have been drying as demand from farms and factories have depleted them. Of the ones that remain, 75 percent are severely polluted, and more than a third of those are so toxic they can’t be used to irrigate farms,

Now we gotta talk about food

Chinese authorities have encouraged companies to gain greater control over the entire supply chain for imported agricultural products.

Enter the United States

- China’s average annual water resources are less than 2,200 cubic meters per capita. The United States, by contrast, boasts almost 9,400 cubic meters of water per person

- The United States has six times more arable land per capita

Pork

The Chinese currently eat 88 pounds per capita annually (Americans eat 60 pounds) They produce and consume half of the world’s pork, so when there are fluctuations in their domestic production – even small fluctuations – it can really increase their need for imports.

To meet the growing demand, China’s hog farms have grown and multiplied, and more than half of the globe’s pigs are now raised there. But even so, its production can’t keep up with the pork craze.

US pork exports to China surged from about 57,000 metric tons in 2003 to more than 2.31 million metric tons (mt) in 2016 which converts to $5.94 billion

It’s cheaper to produce pork in the US than in China.

Our meat industry churns out hogs for about $0.57 per pound, versus $0.68 per pound in China’s new, factory-scale hog farms. The main difference is feed costs. US pig producers spend about 25% less on feed than their Chinese counterparts. We have more abundant land, water, and grain resources.

“Control oil and you control nations; control food and you control the people.”

So, China buys Smithfield Pork…

In an effort to cut out the middleman, China is trying to circumvent the American farmer. Instead of buying food from farmers who work their own land, they want to own and operate these American farms themselves—as well as the livestock barns and slaughterhouses.

Chinese consumers, pay a large premium for US pork as it is viewed as higher quality due to our strict food safety laws.

Shaunghui

Shaunghui is a Chinese meat-processing company in 2013, purchased Smithfield for 30 percent over its market value. It was the largest purchase of a U.S. company by a Chinese firm and the first acquisition of a major American food company by a Chinese business.

The U.S. Treasury Department allowed the purchase to go forward after assurances from Smithfield CEO Larry Pope that there was no connection between Shaunghui and the Chinese government. A year later it was discovered that the Chinese government did have a connection to Shaunghui. The Communist Party supported the Smithfield purchase with “preferential policy”, as well as “investment,” Zhang Taixi, the government-appointed president of WH Group (the corporate name Shaunghui adopted in 2014), told investigative reporters.

The WH Group advanced the China Communist Party aims to own the entire production chain for pork with the least geographic distance between U.S. pork production and the Chinese market.

One of the benefits to owning every aspect of production from feed through packaging is that you can increase production on demand.

Syngenta

ChemChina, a China Communist Party owned company, recently bought Syngenta, a Swiss agrichemical company, for 43 billion dollars, and this creates a bigly foothold in feed production. What if the Chinese government becomes of the largest players in American agriculture.

We’ve handed over a vertically integrated system to a foreign government.

A side effect of that is the damage left in its wake, production leads to more barns being built and, in turn, waste coming out of those barns. You need more feed for those pigs, so you’re raising more row crops and putting more of that waste onto the fields, it’s a feedback loop.

Between 2007 and 2012, Iowa had the largest increase in hog and pig sales of any state in the country, a jump of $1.9 billion.

The number of polluted Iowan waterways increased 15 percent between 2012 and 2014. Not only do the waste pits used to capture manure from large hog operations produce antibiotic-resistant bacteria, the pathogens can travel miles away.

When a foreign investor buys up land, the local population loses farming rights, which can lead to people losing their homes, livelihoods, and access to resources like water.

To preserve its well-being, Iowa outlawed selling farmland to foreign buyers.

The median age of the American farmer is 55, in the next five years about 92,000,000 acres will go up for sale.

In addition to ramping up foreign meat purchases, China is also importing enormous amounts of feed to do so. The Chinese and their hogs, chickens, and cows consume 60 percent of the global trade in soybeans, and the government may soon also ramp up corn imports—because while Beijing currently limits foreign corn purchases, meat producers are clamoring for more. And where does a third of the globe’s corn come from?…

The USA.

China ramps up its investments

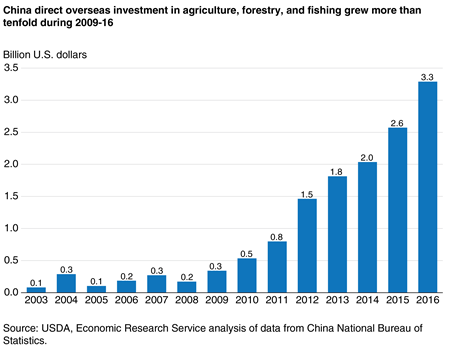

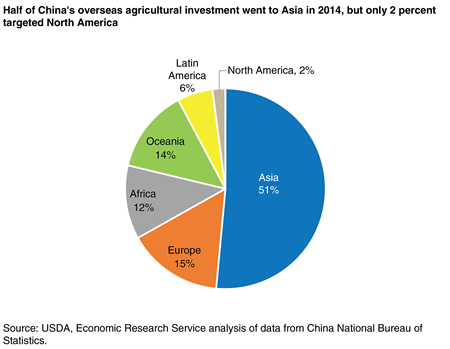

China’s spending on foreign agricultural ventures is modest compared with the country’s agricultural imports. In 2016, the country’s foreign agricultural investment equaled just 3 percent of the value of its agricultural imports that year.

Agricultural investment has lagged behind other sectors in China’s foreign investment surge. Agriculture, forestry, and fishing accounted for about 1.7 percent of China’s foreign investment from 2012 to 2016. By comparison, agriculture’s share of China’s gross domestic product is about 9 percent.,,

but that number is gonna change, bigly.

China threatens bigly tariffs against itself

The Chinese government has proposed a 25 percent tariff on U.S. pork products, 309,000 tons of which were shipped to China last year. A tariff that is all bark, no bite. Will the Chinese tax themselves? Would you?

OMG, the Chinese are gonna stop buying US soybeans!

Smithfield wont take a hit from those tariffs that will not, and cannot, be imposed against “US. pork”, but they also threaten a boycott against US. soybeans. China imported $14.2 billion of American soybeans in 2016. You know what they use it for?

To feed their pigs and other livestock. Any disruption in that supply chain could throw the market off. Could they buy from other countries? Yes, but it would significantly disrupt their own ecosystem of sourcing efficiency, it would cost them bigly more to buy non US. soybeans.