- This post is part of a series of essays on the Biden infrastructure bill, what ‘it’ is and what ‘is’ it?

- This is chapterized, table of contents below, so that you can quickly click to whatever floats your boat

- Nothing here will be comprehensive because if it was you wouldn’t read it – which is okay cos I wouldn’t write it

- This is meant to be a post-mortem sampler that better informs perspective on what’s happened before, and hopefully promotes a deeper inquiry and inspection into this new monstrosity. You have to know what questions to ask, or at a minimum to contemplate, and that’s what I hope this is

Table of Contents

The $1 trillion dollar infrastructure bill

This post is about the the fraud of “it’s not fraud” fraud.

We can’t figure out what is is until we look back at what we got before. Let’s begin…

Prolog: Obama is President:

January 7, 2009: “Picture a sweaty brow, rolled-up sleeves, knotty forearms, calloused hands. Picture virgin land, just waiting to be transformed. Shovel-ready land. This is America on the eve of the Obama era” – Washington Post, January 2009

January 9, 2009: “U.S. employers shed 524,000 jobs in December…job losses brought the total for 2008 to 2.6 million…The unemployment rate jumped to 7.2 percent in December” – NY Times

January 9 2009: President Obama’s Advisers Predict The Stimulus Would Lower Unemployment To 5.3%

Chapter 1: ARRA

February 17, 2009: President Obama signs the $800+ billion stimulus plan called American Recovery and Reinvestment Act of 2009 – ARRA

$381 billion in federal tax cuts

$98 billion dedicated to transportation and infrastructure spending: largely allocated to Renewable Energy projects

$318 billion in transfers to state and local governments for range such as:

- K-12 Education and Higher Education

- preserving teaching jobs

- incentives for job retention

- Medicaid

- Health and Human Services

- Unemployment Benefits

- Corrections for underfunded programs

Besides being a massive stimulus program on the heels of the Great Recession (2007-09), the act was controversial as to how and when government should intervene in the economy.

More expensive than the “New Deal”

Maybe. Depending on the intricacies of the calculations, a side by side comparison can’t be exactly made due to population growth, share of Gross Domestic Product, Gross National Product, etc, but it is fair to say ARRA was the most expensive government spending program in American history

Transparency & Accountability Provisions

ARRA includes provisions for transparency and accountability for all funds made available by the law. Information on expenditures from stimulus funding and implementations were public thru several agencies and websites.

The Recovery Accountability and Transparency Board was created, comprised of a chairperson appointed by the President and Inspectors General from the Departments of Agriculture, Commerce, Education, Energy, Health and Human Services, Homeland Security, Justice, Transportation, and Treasury, and any other inspector general designated by the President from any agency that expends or obligates Recovery Act funds

Report on the Use of Funds Title XV Subtitle A (P.L. 111-5) – Sec.1512

c) Recipient Reports- Not later than 10 days after the end of each calendar quarter, each recipient that received recovery funds from a Federal agency shall submit a report to that agency that contains:

-

the total amount of recovery funds received from that agency;

-

the amount of recovery funds received that were expended or obligated to projects or activities; and

-

a detailed list of all projects or activities for which recovery funds were expended or obligated, including:

-

the name of the project or activity;

-

a description of the project or activity;

-

an evaluation of the completion status of the project or activity;

-

an estimate of the number of jobs created and the number of jobs retained by the project or activity; and

-

for infrastructure investments made by State and local governments, the purpose, total cost, and rationale of the agency for funding the infrastructure investment with funds made available under this Act, and name of the person to contact at the agency if there are concerns with the infrastructure investment.

-

Additional Financial Reporting (ACF-696 & ACF-696T)

As part of the efforts to ensure transparency and accountability, the ARRA requires Federal agencies and grantees to track and report separately on expenditures from funds made available by the stimulus bill.

Rather than report to multiple government entities, each with its own disparate reporting requirements, all recipients of Recovery Act funds were required to centrally report into the Recovery Board’s inbound reporting website, FederalReporting.gov

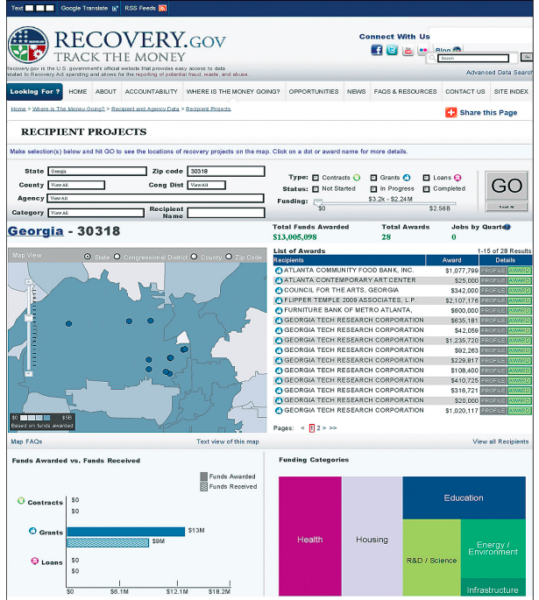

Data was then provided to agencies for review and recipients were requested to make any needed corrections. The Recovery Board then made the data available on its website, Recovery.gov

Recovery.gov enabled users to locate Recovery Act projects on a block-by-block basis.

The home page of Recovery.gov

Users could access data reported by recipients of Recovery awards through the Recovery application program interface (API) and the Mapping API. There were data summaries by state, county, congressional district, or ZIP code as reported by recipients.

States had the flexibility to design their own portals

NYSTATE Stimulus Tracker

The Stimulus Tracker went several layers deeper and broke down each award into several projects, each of which had its own dashboard page that displayed information such as

- Status of the project

- Percentage of total funds spent

- Start date and spending deadlines

- Number of jobs created or retained

Visitors to the site could drill into a record of every payment made with stimulus funds through the additional feature “Payment Tracker” and every contract to carry out stimulus-funded work through “Contract Tracker”

Stimulus Tracker also offered an interactive map for site visitors who were interested in knowing how stimulus dollars were allocated geographically and where specific projects were located. This information was layered on top of the city’s existing online map portal and could be drilled down to every project at any discrete location.

![]()

The system was not perfect, for example…

The miseries of redundancy in reporting systems

As an example…

At the Department of Transportation they had to report to three systems

- Internal state system

- DOT’s system

- FederalReporting.gov

Miseries of disparate reporting platforms, the lack of consistent data and standards and commonality in how data elements are defined placed burdens on federal fund recipients which could result in them having to report the same information multiple times via disparate reporting platforms.

FederalReporting is shut down

After years of inadequate funding, little staffing and scant resources, the infrastructure and data analysis tools to service the Recovery Board, called the Recovery Operations Center (ROC) ended when the Board went out of existence in 2014.

Digital Accountability and Transparency Act of 2014

The DATA act of 2014 had authorized the Dept of the Treasury to expand the Recovery Board. But the Treasury Department declined, arguing that it was not “cost-effective or add value to Treasury Operations.”

The DATA Act requires federal agencies to prepare and submit standardized, accurate information about the trillions of dollars they spend each year.

Inspector Generals

Each Federal agency has an Office of Inspector General (OIG) that conducts audits and based on their findings they make recommendations to improve program efficiency, address systemic weaknesses, and initiate administrative action, recommend changes in Federal laws, regulations, and policies.

OIG is also conducts criminal investigations involving fraud, embezzlement, and public corruption.

There is a business in the fraud of fraud and that means not paying for detectives to ‘detect.’

Inspectors General are funded like pouring water in a bucket with holes.

“…I believe that, on the whole, OIGs have been under funded…We had 406 employees in 1992, and we have about the same number today…our responsibilities have increased dramatically. Congress has repeatedly called on us to conduct additional reviews, both by incorporating such requirements in statutes and by making specific requests. Over the years, our responsibilities have increased in many important areas, ranging from oversight of computer security and information technology investments, requirements under the Patriot Act to report on civil rights and civil liberties abuses, increased oversight of the FBI, and other mandates to conduct sensitive investigations and audits.” – Glenn A. Fine, Inspector General, U.S. Department of Justice

From the OpEd above:

“…the Special Inspector General for Afghanistan Reconstruction (SIGAR), has issued more than 300 reports and identified more than $2 billion in savings to the U.S. taxpayer. We’ve reported on a taxpayer-funded building so poorly constructed its walls melted in the rain, and exposed the expenditure of $500 million on transport planes that were so unsafe they were eventually turned into scrap…Much of our work comes at the direction of Congress…“

These words are interesting, they are not accidental, they are exact…

- “Issued”

- “Identified”

- “Reported”

- “Direction of Congress”

Inspector Generals offices are being starved of money, staff, resources.

This happened…

COVID Money

In March 2020 Congress passed a $2.2 trillion economic relief bill known as the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Additionally new bills were passed and the all-in was about $5 trillion

The federal government provided about $5 trillion in relief money in three separate legislative packages

“…But investigators say that Congress, in its haste to get money out the door, devised all three packages with the same flaw: relying on the honor system.“

Pandemic fraud

Those dollars came with few strings and minimal oversight. The result: one of the largest frauds in American history, with billions of dollars stolen by thousands of people, including at least one amateur who boasted of his criminal activity on YouTube.

“The federal government distributed funds quickly during the COVID-19 pandemic. This led to an increase in fraud and other “improper payments“—payments that shouldn’t have been made or were made in the incorrect amount. The extent of fraud in COVID-relief programs is not yet known but our estimate suggests that one program, Unemployment Insurance, made over $60 billion in fraudulent payments.”

So you can pick up what I’m putting down, that’s $60 billion dollars from one program alone, paying out unemployment insurance.

“…It sent money to “farms” that turned out to be front yards. It paid people who were on the government’s “Do Not Pay List.” It gave loans to 342 people who said their name was “N/A.”

Fraud so bad that fraud is a fraud

“During a Senate Homeland Security and Governmental Affairs Committee hearing today, PRAC Chairman Michael Horowitz pointed to a finding from the committee’s October 2021 report that found 15,000 relief grants worth $33 billion had “meaningless descriptions” that make it almost impossible to discern how the funds were spent.”

“One of the many challenges in determining the full extent of fraud is its deceptive nature. Programs can incur financial losses related to fraud that are never identified and such losses are difficult to reliably estimate.”

That wasn’t even close to all the fraud, this ALSO happened

“They came into their riches by participating in what experts say is the theft of as much as $80 billion — or about 10 percent — of the $800 billion handed out in a Covid relief plan known as the Paycheck Protection Program, or PPP“

“Even if the highest estimates are inflated, the total fraud in all Covid relief funds amounts to a mind-boggling sum of taxpayer money that could rival the $579 billion in federal funds included in President Joe Biden’s massive 10-year infrastructure spending plan”

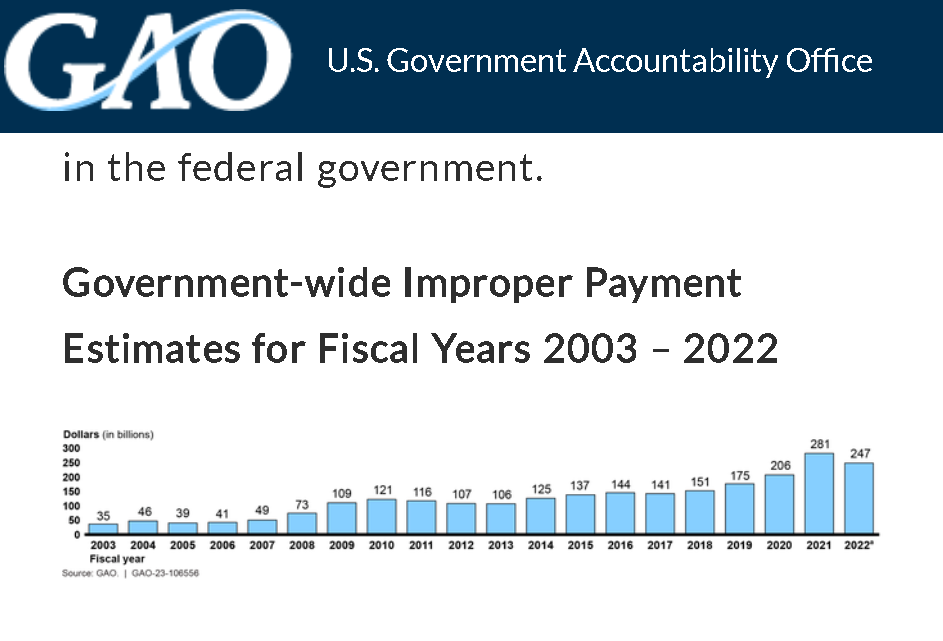

The chart is not adjusted for inflation

GAO identified major factors that contributed to federal programs’ exposure to fraud, improper payments:

- Did not strategically manage fraud risks and were not adequately prepared to prevent fraud

- Lacked appropriate controls to prevent, detect, and recover fraudulent and other improper payments

- Lack permanent, government-wide analytic capabilities to help agencies identify fraud

Lesson

Listen to the above statement from Nancy Pelosi that I had at the beginning, note there is ‘nothing there, there‘ and therefore there is nothing to investigate ‘there.‘

“Next time we’ll do better” “we have learned from this” and so on and so on

Here’s a report, whatever

Intermission – Bailouts

Bank Bailout

February 2007 – U.S. Housing Bubble Bursts

The boom in U.S. housing prices reversed in 2006. The drop accelerates in 2007, the largest single-year drop in U.S. home sales in more than two decades. The downturn triggers a collapse of the U.S. subprime mortgage industry.

More than twenty-five subprime lending firms declare bankruptcy in February and March 2007.

July 2007, Bear Stearns one of the largest invest banks, announces two of its hedge funds have lost almost all of their investor capital and will file for bankruptcy. It is one of the first signs of major problems in financial markets beyond the subprime loan industry.

August 2007

France’s BNP Paribas announces that there is no liquidity in the market for the assets held by three of its hedge funds, as investors reject these so-called toxic assets, which are rapidly losing their value.

With lending markets drying up around the world, the central banks of the United States, the European Union, Australia, Canada, and Japan coordinate to inject liquidity into credit markets for the first time since 9/11.

September 2007

The Federal Reserve makes its first in a series of interest rate cuts, lowering the benchmark federal funds rate for the first time since 2003, from 5.25 percent to 4.75 percent.

By December 2008, the Fed will cut rates to between 0 percent and 0.25 percent.

Bear Stearns announces major liquidity problems and is granted a twenty-eight-day emergency loan from the New York Federal Reserve Bank. Two days later, JPMorgan Chase buys Bear Stearns for $10 per share in a rescue deal backed by $30 billion in Fed financing. Bear Stearns stock traded at $172 per share weeks earlier.

September, 2008

September 2008, Hank Paulson, formerly CEO of Goldman Sachs and at that the Treasury Secretary, told Congress that $5.5 trillion in wealth would disappear by 2 p.m. that day unless the government took immediate action, and that the world economy would collapse “within 24 hours.”

(by 2015 the bailout was still, secretly, in force, total commitment of government was $16.8 trillion dollars)

In 2009 Government documents obtained and released by Judicial Watch revealed that Paulson had forced 9 banks into bailouts anf gave them no choice but to accept capital infusions from the Treasury Department, thereby the government took direct stakes in the banks through $125 billion in preferred stock purchases.

The U.S. government announces it will seize control of federal mortgage insurers Fannie Mae and Freddie Mac as federal regulators fear their collapse could lead to massive collateral damage for financial markets and the U.S. economy

Lehman Brothers, files for the largest bankruptcy in U.S. history. The announcement spooks investors who had assumed the U.S. government would act to prevent a bank the size of Lehman from failing.

The Fed steps in to rescue American International Group, the largest insurer in the United States, with an $85 billion loan.

September 2009 Treasury Secretary Henry Paulson unveils a rescue plan dubbed the Troubled Asset Relief Program, or TARP, which aims to use $700 billion of U.S. taxpayer money to stabilize markets.

Washington Mutual is seized by the Federal Deposit Insurance Corporation and declares bankruptcy, the largest bank failure in U.S. history. Several days later, another major U.S. bank, Wachovia, is purchased by Wells Fargo.

Federal Reserve moves to make an additional $900 billion of short-term lending available to banks and announces plans to lend approximately $1.3 trillion to companies outside the financial sector.

The central banks of the United States, the EU, Britain, China, Canada, Sweden, and Switzerland make coordinated interest rate cuts.

The U.S. economy sheds 240,000 jobs in October, ushering in a period of heavy job losses that culminates in an unemployment rate of 10 percent a year later.

November 25, 2008:

The Federal Reserve introduces a plan to make large-scale asset purchases, known as quantitative easing, to push down long-term interest rates and jumpstart economic activity.

(In March 2009, the Fed announces the purchase of $750 billion in mortgage-backed securities and $300 billion in U.S. Treasuries)

The money had no requirements, it could use it for any purpose. Including bonuses. In 2007/8 alone 1.6 billion was paid to banks execs as bonuses

Auto Bailout

The auto companies of Detroit saw an open spigot of money and rushed towards it.

The Troubled Asset Relief Program (TARP) authorized the secretary of the Treasury “to purchase…troubled assets from any financial institution, on such terms and conditions as are determined by the Secretary”; the law also gave the Treasury secretary power “to take such actions as the Secretary deems necessary to carry out the authorities” in the legislation.

The boundaries set on the use of these funds were so vague and so loose as to produce something approaching a slush fund for the Treasury.

And yet, the TARP legislation did not permit the use of the allotted funds to bail out automakers. The car companies were not “financial institutions.”

Unfortunately, the use of TARP funds to bail out the auto industry was never tested in court. Although a challenge was raised by some of Chrysler’s creditors as part of the company’s bankruptcy case, the bankruptcy court refused them standing on that issue (arguing that the particular mechanism behind the bailout was not relevant to their claims).

The Supreme Court later held any further challenges to the legality of any aspect of the Chrysler case to be moot.

(challenge was by three Indiana state funds and several consumer groups to the sale of most of its assets to Fiat.

The decision by the Supreme Court made it clear that the justices were not ruling on the merits of the challenge by the Indiana funds, which had protested the government’s treatment of Chrysler’s secured lenders.

Instead, according to the order, the Indiana funds “have not carried the burden” of proving that the Supreme Court needed to intervene.)

America auto companies

In 2006, none of Consumer Reports Top 10 cars was made by U.S. based automakers.

By 2008, sales had fallen by 400k autos in a year, this is about two factories’ annual output. Over the 12 months ending in the fourth quarter of 2008, personal new vehicle sales fell by $107 billion. GM had lost $40 billion

The CEOs of Ford, Chrysler and GM appealed to Congress for a bridge loan, they arrived via corporate jet.

In Dec 2008, Bush tapped TARP funds (Wall St bailout) for the 1st round of money to go to Detroit, enough to stay operational for the first several months of the Obama presidency.

- GM owed $6b to secured creditors, $30b to unsecured creditors.

- C owed $7b to first-lien secured creditors, $2b to second-lien secured creditors, $5b to unsecured trade creditors & billions more in obligations to dealers/warranties.

The United Auto Workers (UAW) had also created significant liabilities for Detroit.

- General Motors paid its unionized workers $70 per hour in wages & benefits.

- Chrysler paid $76 an hour. substantially more than foreign companies with US Auto employees were paying.

Who is the United Auto Workers?

- UAW membership was 700,000 in 2001, in 2008 it had 355,000 active members & 600,000 retirees.

- Staff of more than 2,000.

- In 2008 the UAW brought in $211 million and spent more than $268 million.

- Half of the union’s $ outflow was staff, another $20 million was travel conferences.

UAW employees at GM & C can collect pensions in their 50s. The automakers also provided UAW retirees with full health coverage until they became eligible for Medicare after which UAW retirees in 2006 had maximum out-of-pocket expenses of +/- $200

UAW held $1b in stocks/bonds, $38m in land, DC mansions, and… an 18-hole golf course 4 hours away from its autoworkers in Detroit.

In 2008, the UAW-PAC spent $13.1m on Dem political races, another $4.88 million in independent expenditures, $4m in support of Obama

Obama takes office

With the Detroit CEO’s and UAW execs and it’s on the street vocal forces, appropriated the language of the Iraq war’rs and the bank bailout’rs, if they didn’t get money, the world might end and we would have to fight for our meals in the Thunderdome

Auto companies wanted bankruptcy to allow them to (re)negotiate their enormous accrued obligations, and to force unions to new rounds of collective bargaining over their wages, benefits and pensions.

The Obama administration commandeered the bankruptcy process to reward the UAW, at the expense of auto investors, the credit markets and the future.

- C secured creditors, who would have had priority in a normal bankruptcy, received only 29 cents on the dollar.

- UAW got more than 40 cents on the dollar, even though they are equivalent to low-priority lenders.

- UAW retirees got 100% of their pension/retirement benefits.

- 21,000 NONunion employees lost up to 70 percent of their pensions, and all of their life and health insurance.

The new auto co’s that resulted from Obama coerced bankruptcies did not resolve labor costs & still had most of their legacy costs

The bailout wasn’t auto, it was UAW. And it cost taxpayers well over $10 billion dollars.

It is claimed by some that the auto bailout saved 1+ million jobs, this is very heavily disputed, but I offer that claim in fairness and noting that the analysis was done by the Center for Automotive Research, certainly a conflict. Also their report assumes every American auto job would have been lost, but whatever.

Healthcare Bailout

Obamacare and the ACA act. I’ve written a lot about this, and…I’m actually an expert on the “creature”, “fiend”, “spectre”, “the dæmon”, “wretch”, “devil”, “thing”, “being””ogre” – Words that Victor Frankenstein used to refer to his monster

Chapter 2: “Shovel Ready”

The media was in high voltage propaganda as it promoted, in gradations of fervor, the Auto Bailouts, Bank Bailouts and ObamaCare.

As President Obama was urging Congress to pass the $800 billion-plus stimulus package, one of his selling points was that thousands of projects nationwide that he called “shovel ready” would immediately commence.

By his definition – at that time – shovel ready meant planning is complete, approvals are secured and people could be put to work right away once funded.

January 6, 2009: A report released by the U.S. Conference of Mayors entitled “Ready to Go” in early December listed more than 11,000 projects in 427 cities, many of which already have local approval.

The total cost for the projects — everything from a $100,000 driving simulator for Goodyear, Arizona to a $20 million expansion of a housing complex for the elderly in West Hartford, Connecticut — would be nearly $73.2 billion and they would create more than 800,000 jobs, according to the group.” – Reuters

January 2009: “Picture a sweaty brow, rolled-up sleeves, knotty forearms, calloused hands. Picture virgin land, just waiting to be transformed….Shovel-ready land…This is America on the eve of the Obama era.” – Washington Post

February 17, 2009, (day of bill signing) “As part of the government spending, they wanted to have all those shovel-ready projects so that the money could be spent as quickly as possible. And the administration has promised that 75% of it will be spent in the next 18 months.” – NPR

March 4, 2009: “The Obama administration has said that the economic stimulus plan will immediately target construction and repair projects that are “shovel ready” investing directly in the nation’s roads, bridges, schools and hospitals” – ABC news

December 2009 Obama gave a speech at think tank Brookings

Obama: “Already, more than 10,000 of these [infrastructure] projects have been funded through the Recovery Act. And by design, Recovery Act work on roads, bridges, water systems, Superfund sites, broadband networks, and clean energy projects will all be ramping up in the months ahead.”

The reality: it’s true that 10,000 infrastructure projects had been “funded” But…

- “Funded” is not the same thing as “underway“

- $31 billion in stimulus funds had only been made “available” as of November 27.

- Of that number only $6 billion had actually been paid out, more than eight months after Obama signed the stimulus measure.

- “Shovel ready” is not a real term, it’s a focus group thing and has no definition. “Ready to go” is the term used within those agencies and means that a state has already done preliminary work for a project, addressed environmental requirements, done necessary public outreach, design work is completed and it’s on an approved state list.

Case Study: Weatherization

$5 billion dollars was allocated to retrofitting homes to improve their use of energy through weatherization and the creation of new ‘green’ clean energy. The Obama and Larry Summers promotion of the program estimated it would weatherize 20,000-30,000 homes a month, an estimated 593,000 homes in the life of the program and put 87,000 Americans to work through partnerships with the Department of Energy and state and local governments.

By Dec 31, 2009 only 9,100 homes had been weatherized nationwide according to the Government Accountability Office.

- Department of Energy said it weatherized more than 22,000 homes by the end of 2010. Either way, it’s a far cry from the 593,000 that the government plans to complete during the course of the Recovery Act, which runs through March 2012.

- The National Association for State Community Services Programs rebuts criticism

By 2012 states were still sitting on $1 billion dollars in unused grant money because of a tortured bureaucracy, in which the federal government paid the states, which paid local nonprofits, which then hired the contractors.

Neither states nor nonprofit groups were prepared to handle 20 to 30 times more money than usual. And federal officials brought ready projects to a standstill in the first year by applying new rules regarding prevailing wages.

Prevailing Wages

The Recovery Act included Davis-Bacon requirements for all weatherization grants. Davis-Bacon is a Depression-era law meant to ensure equitable pay for workers on federally funded projects. Under that law, the grants may only go to projects that pay a “prevailing wage” on par with private-sector employers.

The Department of Labor spent most of 2009 trying to determine the prevailing wage for weatherization work, a determination that had to be made for each of the more than 3,000 counties in the United States, according to the GAO report.

Michigan

In Michigan +/-90% of the homes in line for weatherization work needed a historic preservation review. But the office responsible had only two employees and didn’t have the budget to hire more.

Delaware

In Delaware the weatherization program was suspended due to reports of gross mismanagement and fraud, for example paying contractors to do simple, inexpensive fixes — like insulating attics or sealing gaps — but instead replaced furnaces, windows and doors, all at a much greater cost. Much of the work was authorized by an administrator.

As of 2015 only 689 homes have been retrofitted and +/- 6,000 families are on the waiting list.

The state had until March 2012 to use its federal allocation or it will be returned to the Treasury Department.

Shovel ready never happened and those jobs that were promised, didn’t. More about this later when we look at total job creation.

“Shovel-ready was not as shovel-ready as we expected.” – Obama, June 2011

Lesson

Watch this video of President Biden’s remarks on the passage of the Infrastructure Bill.

“once-in-a-generation investment that’s going to create millions of jobs modernizing our infrastructure — our roads, our bridges, our broadband, a whole range of things — to turn the climate crisis into an opportunity. And it puts us on a path to win the economic competition of the 21st century that we face with China and other large countries and the rest of the world.”

The entire thing is a lesson in the semantics of deniability