Table of Contents

This post will make you a black belt, 1st degree, in the dollar.

You will be able to disarm pseudo experts who will hit you with gems like “fiat currency” “petrodollar” and “global reserve” and when they show you their favorite nonsense charts you will be able to kick it out of their hands.

Chapter 1. The dollar is a vehicle currency

On a daily basis, the value of global foreign exchange transactions is greater than the total global value of economic output and the value of all traded stocks and bonds. Every day the world turns over many times.

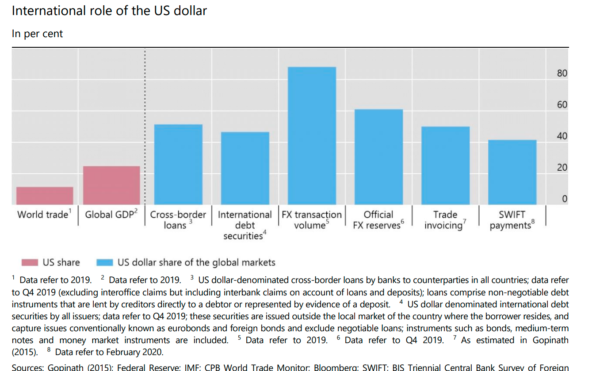

The dollar…

- Accounts for 88% of daily global foreign exchange market turnover of around $7 trillion, this is four times the annual amount of all U.S. exports of goods and services

- Accounts for 61% of official foreign exchange reserves

- Around half of international trade is invoiced in US dollars

- Around 40% of international payments are made in US dollars

Why is the dollar so active?

If the world was only one country doing business with one other country, transactions would be simple, bilateral trade with only two countries and two currencies.

But there are hundreds of countries and currencies and each country on our blue marble runs a balance of payments surpluses with some countries, deficits with others, even when its overall payments are in equilibrium. This is a ‘multilateral structure of payments’.

People who want to exchange one currency for another will not necessarily make the exchange directly. They may make the exchange by way of some third currency, which becomes a vehicle for the transaction. This is the dollar, the dollar is a “vehicle currency”, this means that agents and intermediaries in non-dollar economies engage in currency trade indirectly using the U.S. dollar instead of using direct bilateral trade among their own currencies.

Let’s discuss this:

The world of commerce has friction, and there are transaction costs of trading. Lead agents and intermediaries need to make and receive payments in a currency that has a high trade volume, liquidity, low transaction costs and is widely acceptable to all countries.

It is cheaper for payments between agents and intermediaries in small countries with thinly traded currencies to be made indirectly using US dollars than to use direct bilateral trade in their own currency markets. That is, by eliminating costly bilateral exchange in small currency markets, a vehicle currency can reduce the transactions cost of exchange.

Trading posts

ABC corp is a firm exporting their product into a foreign market. ABC has three options (or a combination of these three)

1) Invoice the transaction in its own currency (Producer’s Currency Pricing, PCP)

If an exporter firm ABC sets its export price in its own country’s currency the price paid by its foreign consumers moves with the exchange rate

2) Invoice in the currency of the destination country (Local Currency Pricing, LCP)

If the price is in the currency of its customers abroad, the export firm ABC bears the exchange rate risk

3) Invoice in a third currency (Vehicle Currency Pricing, VCP) this solution uses neither ABC’s currency nor the overseas/foreign customer’s.

If you were the CEO of that exporting firm you have an incentive to limit the movement of your price relative to that of your competitors, leading you to invoice in the same low transaction cost currency as your competitors. This is an example of one of the economic features that leads to a currency becoming the dominant medium of invoicing in the market.

Your company, ABC corp has no incentive to invoice in an alternative currency as this would lead to higher transaction cost and more volatile sales because of movements in price relative to your competitors.

And so on

Chapter 2. Our Dollars in their banks. How the world pays its bill

Around 85% of all foreign exchange transactions occur against the US dollar. It is the world’s primary reserve currency, accounting for 61% of official foreign exchange reserves. Around half of international trade is invoiced in US dollars, and around 40% of international payments are made in US dollars (I used 2019 numbers to avoid the Covid shocks both up and down as these have essentially smoothed and although the dollar is now stronger, its share of total trade is about the same)

Now we are going to talk about how the dollar is used, who is using it and why they’re using it. Read on…

The United States is the world’s largest trading nation, with over $5.6 trillion in exports and imports of goods and services in 2019. The U.S. has trade relations with more than 200 countries, territories, and regional associations around the globe. The United States is the 2nd largest goods exporter in the world.

- $23 trillion dollars, about 26% of the entire world’s total GDP and about 50% of all outstanding international debt securities and cross-border loans are in US dollars.

- Although the US share in world trade is only about 10%, US dollar invoicing is around 50%

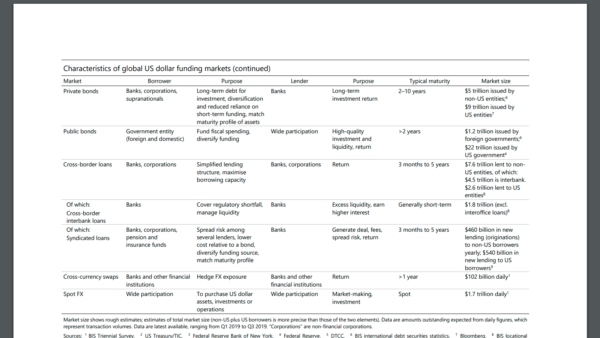

The growth of global US dollar funding in recent years has largely been driven by market-based financing. Over the past several years, around 75% of the increase in international US dollar funding has been in the form of marketable debt securities rather than bank lending.

In that time, the stock of US dollar international debt securities has risen relative to global GDP, while bank lending has shrunk relative to global GDP to around its levels of the early 2000s. As a result, international US dollar debt securities now exceed bank loans, having been around 60% as large a decade ago.

‘What Happened’

After the Great Financial Crisis, banks’ asset growth was been limited as they focused on improving risk management and repairing their balance sheets. As banks were cleaning up risk, financial activities migrated outside of the banking sector. Institutional investors, non banks like pension funds and private equity, were getting massive inflows of capital that was pursuing a better yield in an environment of low global interest rates.

This is a crash course, a lot of questions and lot of answers

Why do non-US entities want to borrow US dollars?

- Borrowers, especially in Emerging Market Economies (EMEs) with high domestic inflation and weaker domestic institutions, might have to issue debt in the US dollar to attract lenders.

- There is a short but possibly very expensive period between when prices are determined and payments are made in International Trade. Non-US firms (sellers or buyers) face exchange rate risk which can be the most efficiently hedged using dollar based instruments (FX forward and swap markets, discussed a little bit later)

Why do US entities lend in dollars to non-US borrowers?

Many reasons and tops is that the lending US firm may obtain higher returns because non-US borrowers may be willing to pay higher rates given more limited access relative to US borrowers.

- US banks had about $2 trillion in US dollar denominated international claims, mostly in the form of loans (2020)

- US non-bank financial institutions (NBFIs) hold more than $2 trillion of US dollar-denominated debt securities issued by non-US entities Mutual funds have the largest holdings (2020)

Why do non-US entities buy US dollar assets?

There is a deepness to the US dollar market and investors may prefer U.S dollar asset markets because of the ability to conduct large-scale transactions with minimal impact on price.

Non-US entities hold:

- $6.8 trillion, or about 43% of the US Treasuries outstanding (as of August 2019)

- $1.2 trillion, or about 17% of US agency securities outstanding (as of June 2019)

- $4 trillion, or about 25% of outstanding US long term corporate debt (2019 year end)

Non-US entities often obtain US dollar funding in order to buy US dollar assets and thereby achieve a better balance of risk and returns. US dollar assets can help diversify their portfolios and may have other favourable liquidity and risk properties.

- Returns: US dollar assets at times have higher risk-adjusted returns to non-US entities relative to their home currency and to the other alternative assets that they can purchase in their home economy

- Currency reserve managers and other institutional investors need to invest in low-risk, liquid assets such as US sovereign and investment grade (IG) corporate debt

- As a hedge against the adverse effects of domestic inflation and domestic currency depreciation, particularly in Emerging Market Economies, managers will allocate a significant share of their assets into US dollars.

How and why do non-US entities have US dollars to invest

A significant amount of dollars are held by non-US entities for a variety of reasons:

- Official reserves: Central banks have accumulated large US dollar reserves as a result of current account surpluses (their trade surplus is our trade deficit) As of the fourth quarter of 2019 these US dollar reserves held in another country’s central banks was about $6.8 trillion, 61% of all the world’s global foreign exchange reserves.

- International trade: International trade invoiced in US dollars creates large US dollar receivables or will cause banks to hold US dollars to pay for goods

- US dollar intermediation: Non-US bank or non-bank entities obtain US dollars through their financial activities and then may purchase US assets with those dollars to hedge the currency exposure of those liabilities (if you have US dollars, buy US dollar things)

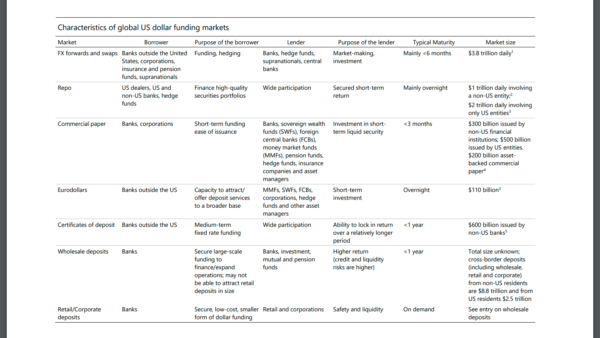

Tape this to your refrigerator, it is the characteristics of the global US dollar funding markets.

And so on

Chapter 3. Petrodollar is it still a thing or is it now just a meme?

Talks of oil & gas producers ditching the US dollar are common these days. most people do not realize:

The currency that is used to price oil must have all of these three characteristics:

- liquidity

- relative stability

- global acceptability.

Global oil trade this year will reach $2.6 trillion dollars. While some currencies are more stable than the US dollar, it doesn’t have the same liquidity, and definitely does not have the same global acceptance.

While China has an oil exchange where oil contracts are denominated in yuan, the price in yuan is mirror image of the dollar-denominated contracts on the Dubai exchange, once adjusted for timing, geographic location, and crude quality. In short, oil remains priced in US dollars.

Why has OPEC continued to price its oil in US dollar?

OPEC has done extensive research on ways to price its oil. Researchers and consultants decided to keep the dollar pricing simply because it’s the best choice. There is no conspiracy here as circulated among certain groups.

In addition to liquidity, relative stability, and global acceptability, OPEC learned that pricing oil in any single currency has the same problems.

Switching, now, to euro, for example, will have the same problems like the dollar. Also, since the US is the largest producer of oil and the largest consumer in the world, any pricing in a single currency means a conversion from the dollar pricing just like the yuan pricing mentioned above: oil will remain priced in US dollars and other currencies will be used to reflect the prevailing exchange rates.

OPEC cannot price its oil in a basket of currencies.

OPEC members are scattered geographically and traditionally have different trade partners.

At the end, oil exports are measured by the amount of goods and services a barrel of oil can buy. Any basket will benefit some members and hurt others. Even if they agree on a basket of currencies, its cost prohibits adoption. It needs to be managed continuously by a world-class experts who will keep changing the content of the basket, a situation that might increase volatility, which violates the second condition mentioned above.

Revenues vs. Pricing

Oil will remain priced in US dollars, but oil producers can switch their revenues into any currency they want.

Switching revenues and funds to ‘no-dollar’ currencies eats into the dollar share, but does not eliminate its dominance.

- If Saudis Arabia switches its oil revenues from China oil sales into yuan, the amount is small, about $50 billion

- US trade alone is more than $5 trillion and the value of global oil trade this year is about $2.6 trillion

- If Saudi Arabia accepts yuan as a form of payment instead of the dollar, let us remember that it is pegged to the dollar

If ditching the dollar is a market-supported choice, why are only the oil-producing countries that the US has imposed sanctions on ‘ditching’ the US dollar?

Putin request that “unfriendly” countries pay for Russian gas in rubles is more of a political stunt than an effective policy. There are several legal, economic and technical issues that will limit the use of rubles.

In addition, the ban by other nations on dealing with Russian banks and reluctance of banks and exchange shops to deal with rubles make the ruble a currency on the sidelines of the international monetary system.

The more Putin pushes others to use the ruble, the more people will shy away from holding rubles. Meanwhile, Russians are hording gold, dollars and Euros. They will sell and buy in ruble per Gresham’s law: “bad money drives out good.”

To conclude: oil will remain priced in dollars. Switching oil & gas revenues to ‘no-dollar’ currencies doesn’t dethrone the dollar or reduce its dominance.

And so on

Guest post by Dr. Anas F. Alhajji, the Editorial Advisor for www.attaqa.net and the Managing Partner at Energy Outlook Advisors LLC, and former Chief Economist of NGP Energy Capital Management. His twitter account is a must follow @anasalhajji

Chapter 4: Will currencies decouple from the dollar. Its happened before

The best illustration of decoupling currency and trading relationships is Europe. Pre-Euro the US had strong relationships with each country, post-Euro the priority for European states was intra-EU trading and its currency component.

Greece and Spain show this well.

Pre-Euro during economic contractions, Greece could weaken the Drachma or Spain the Peseta and that made each locale a more attractive trade partner, more flows from the US and, in essence, an extra element of economic flexibility.

The Euro is a construction of 19 sovereigns, each giving up their ability to control monetary policy or their currency or even their trading relationships, they in essence de-coupled from the US in the effort of re-coupling to a greater degree with other Euro economies.

This has worked out disastrously for the European countries. Initially it was mostly Southern European countries but now it’s pretty much the entire bloc. From the US side, the initial EU launch from 99-08 was semi-successful.

Reserve capital flows going into the Euro vs the US Dollar allowed for a weaker Dollar which enabled higher rates of growth, at least initially. After the European debt debacle in 2011/2012, that impact was lessened and even today there’s long-term concerns about the viability of the union.

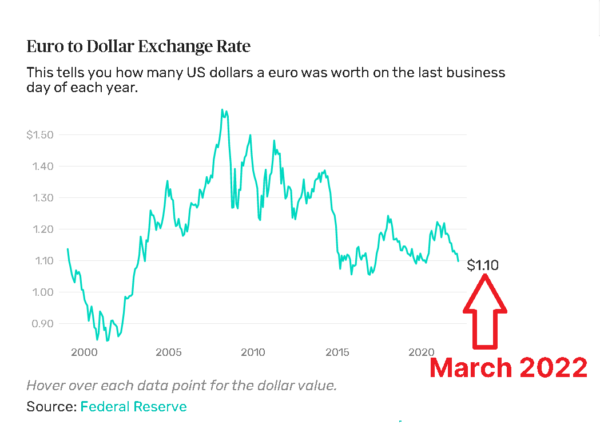

That explains this chart below which shows the Euro giving up ~24% of its value since the top of the Great Financial Crisis. And this is a non-levered currency representing the world’s two largest economies so there’s some considerable impact from this relationship

which shows the Euro giving up ~24% of its value since the top of the Great Financial Crisis. And this is a non-levered currency representing the world’s two largest economies so there’s some considerable impact from this relationship

As far as just direct currency decoupling there’s numerous cases as dollar pegs have been very common.

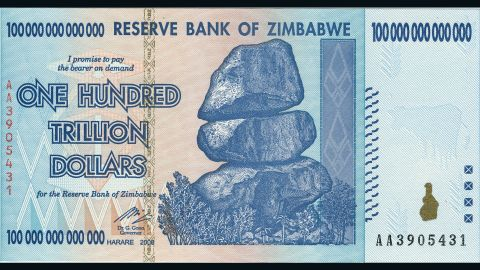

Probably the most extreme is the story of Zimbabwe and the Zimbabwe Dollar from 1980-2009. It was initially pegged to USD but that couldn’t hold for long.

Hyperinflation caused the peg to break, the gov re-denominated the currency multiple times and before they called it all off and moved to just direct USDollars, they started printing these things.

Pretty popular collectors market on Ebay for them but that’s about it.

And so on

Chapter 5. Will the world go Yuan?

The economic health of China is a black box. They report numbers and the rest of the world has to suspend disbelief.

Peeling the Chinese yuan onion

snatched from my anonymous friend Deep Throat

China has a dual currency system.

- The ‘onshore’ currency is the Renminbi (RMB) or yuan and also called the CNY. It is only used to pay bills on the mainland. The onshore currency can’t be used for international transactions. There is no real market for the exchange rate, instead the People’s Bank of China (PBOC) comes up with a price every day thru an unknown equation, and then trades around it.

- The “offshore” currency, also called the yuan or CNH, is used for international clearing and trading. The CNH has a completely separate set of demand and supply conditions from the onshore RMB

The Chinese have it both ways, huge inner stimulation to appease the people. Strong external currency to maintain purchasing power outside.

-

- By controlling the supply of CNH (offshore money) outstanding China can create a CNH shortage. They’d just buy the offshore currency to drive the value/price up.

- Alternatively they can sell the offshore currency, flooding the market with CNH to drive the value/price down. For example, when a foreign Purchaser of goods has to settle the transaction, and there’s a shortage of settlement currency (CNH), his/her cost goes up.

- Conversely, if there are boatloads of CNH available his/her cost goes down.

It’s impossible to simultaneously have

- full capital mobility

- fixed exchange rate

- independent monetary policy.

But they’ve done it…

How this affects trade. Bear with me, we’ve got to get a little technical

- By managing the global supply and therefore the exchange rate of the onshore currency needed by ‘outside’ companies doing business with China, the Chinese Government has been able to generate US$ trillions of additional compensation for their net exports as well as purchase US$ Trillions of EU/Western/Offshore assets at a significant discount.

- Simultaneously, the Chinese Communist Party, the one party owner of the State, has been selling Mainland (RMB Denominated) Assets to EU/Western/Offshore Businesses and Investors at a grossly inflated price.

Economic outlook, debt levels, tail/headwinds, interest rates, politics, supply/demand for the currency, current account balances/deficits and a witch’s brew of other factors all contribute to determining exchange rates. That’s what it means when a currency floats.

The RMB (the onshore only currency) is the only currency issued by a major economy that does not float.

Its value is untethered to the health of its economy and other considerations in the marketplace. Its currency exchange value is ‘made-up’ by the Peoples Bank of China.

Now let’s go backwards and some history of the dollar as it picked up steam

The United States became a larger economy than the United Kingdom in 1872, but the dollar did not begin to displace the pound as the reigning international currency until World War I, and the process was not completed until after World War II.

Germany, Japan and the United States yesterday are like China today.

They became trading powerhouses at a time when their financial systems were tightly regulated. Governments capped interest rates on bank deposits and restricted the investment opportunities of pension and insurance funds so that capital remained cheap.

Financial repression sticks savers with low returns, and the demand for artificially cheap capital often exceeded the supply, leaving some borrowers frustrated that there was little capital available.

Currency internationalization threatens the cheap-capital development model by freeing savers and borrowers to find one another abroad, beyond the reach of regulators.

In the 1970s, President Richard Nixon abandoned the gold standard to permit new mechanisms for printing money. The dollar became as good as gold (despite the fact that it is a fiat currency), which fuels demand for U.S. currency and securities to be used both as an international medium of exchange and store of value.

Now let’s go backwards and some history of the yuan as it picked up steam

In 2008 during the shocks of the Great Financial Crisis, China began to encourage the use of its currency in international trade.

Five pilot regions were rolled out in Dongguan, Guangzhou, Bhanghai, Shenzhen, and Zhuhai which would conduct trade with Hong Kong in yuan. In 2010 it was extended to 20 provinces, cities, and autonomous regions. In 2011 it was extended to the entire country

In 2011 China signed central bank swap agreements with many countries, Argentina, Indonesia, Malaysia and so on and Nigeria’s central bank converted between +/-5% of its reserve assets into yuan.

By 2011

- China’s trade transactions settling in yuan had a 13x increase over the same period during the previous year

- Yuan deposits in Hong Kong were up 10x

In 2015 IMF included the CNH in a basket of major currencies that determines the value of Special Drawing Rights (sdrs) a currency mix countries receive when the IMF disburses financial aid.

Now we are here, in 2022.

Why would China want its currency to be the big boy international reserve?

Good question, I’m glad I asked.

They don’t.

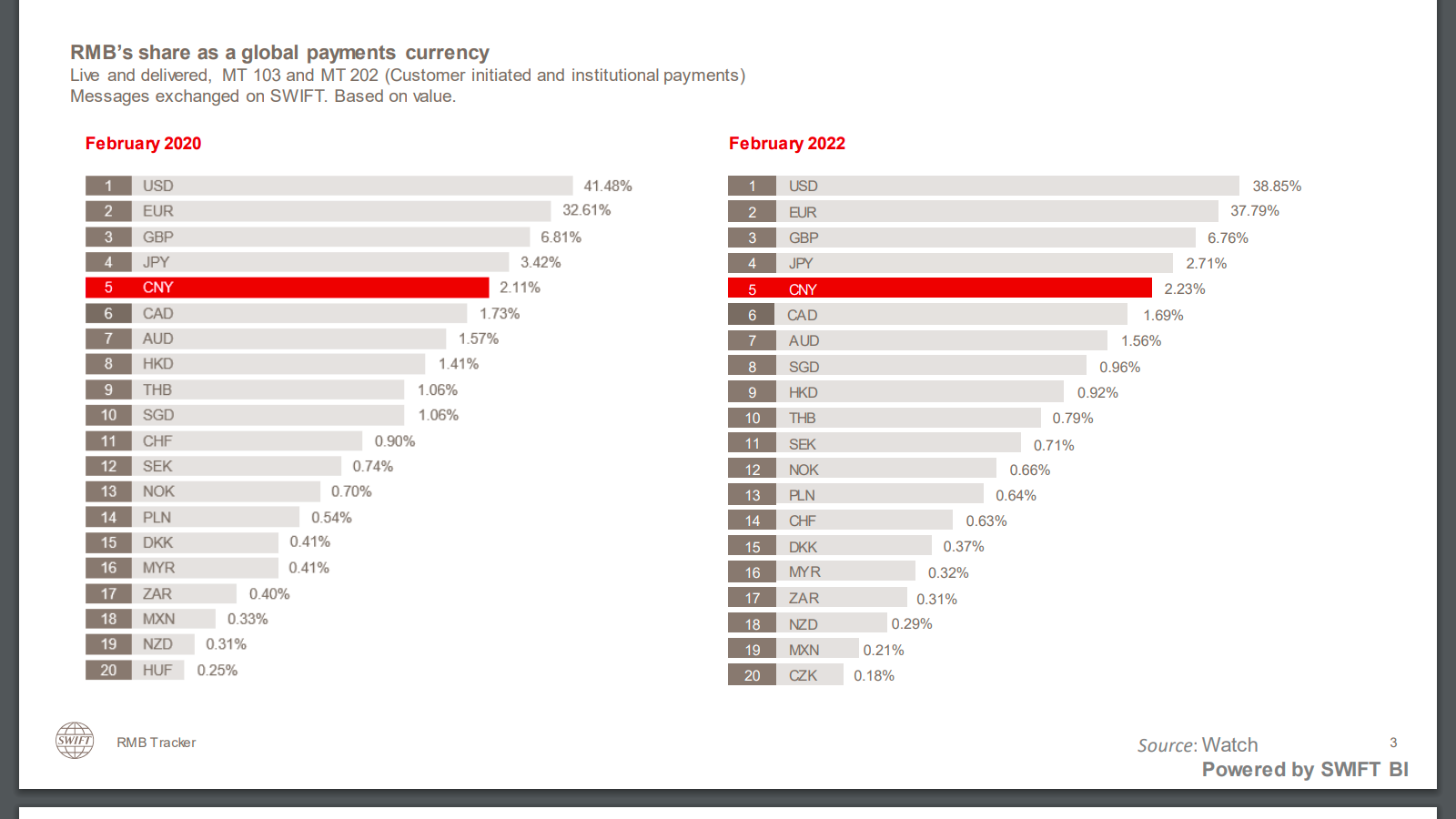

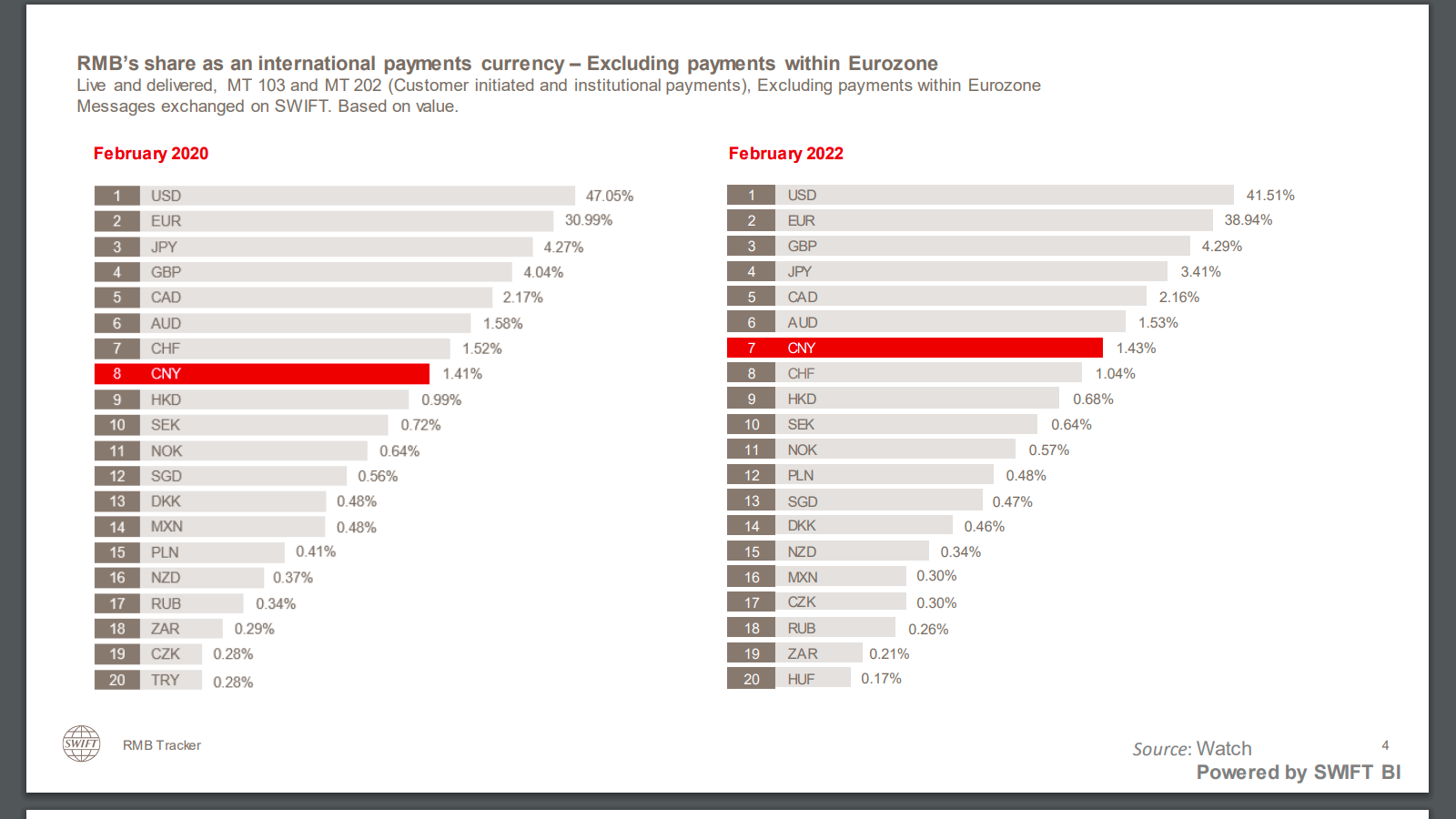

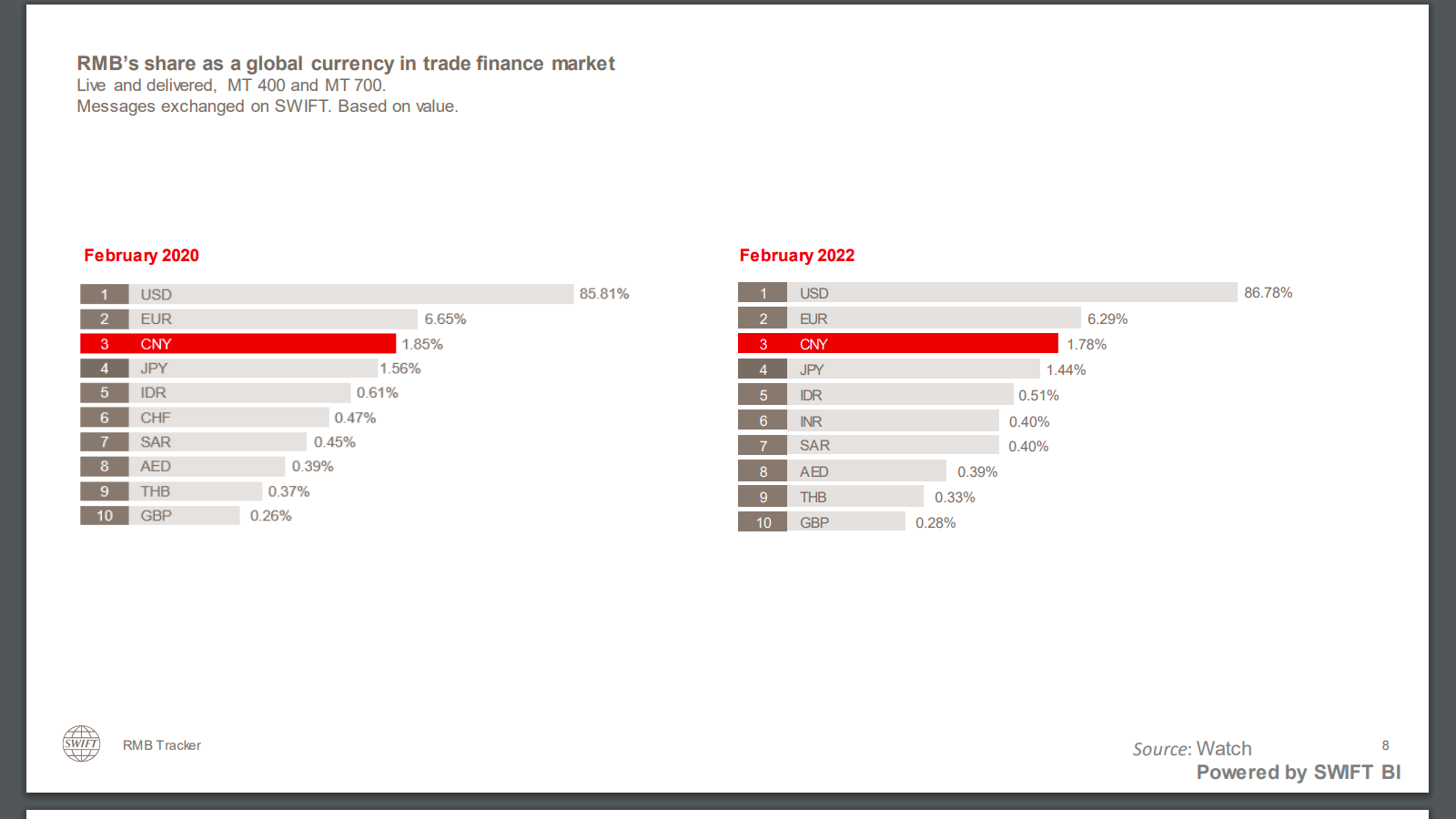

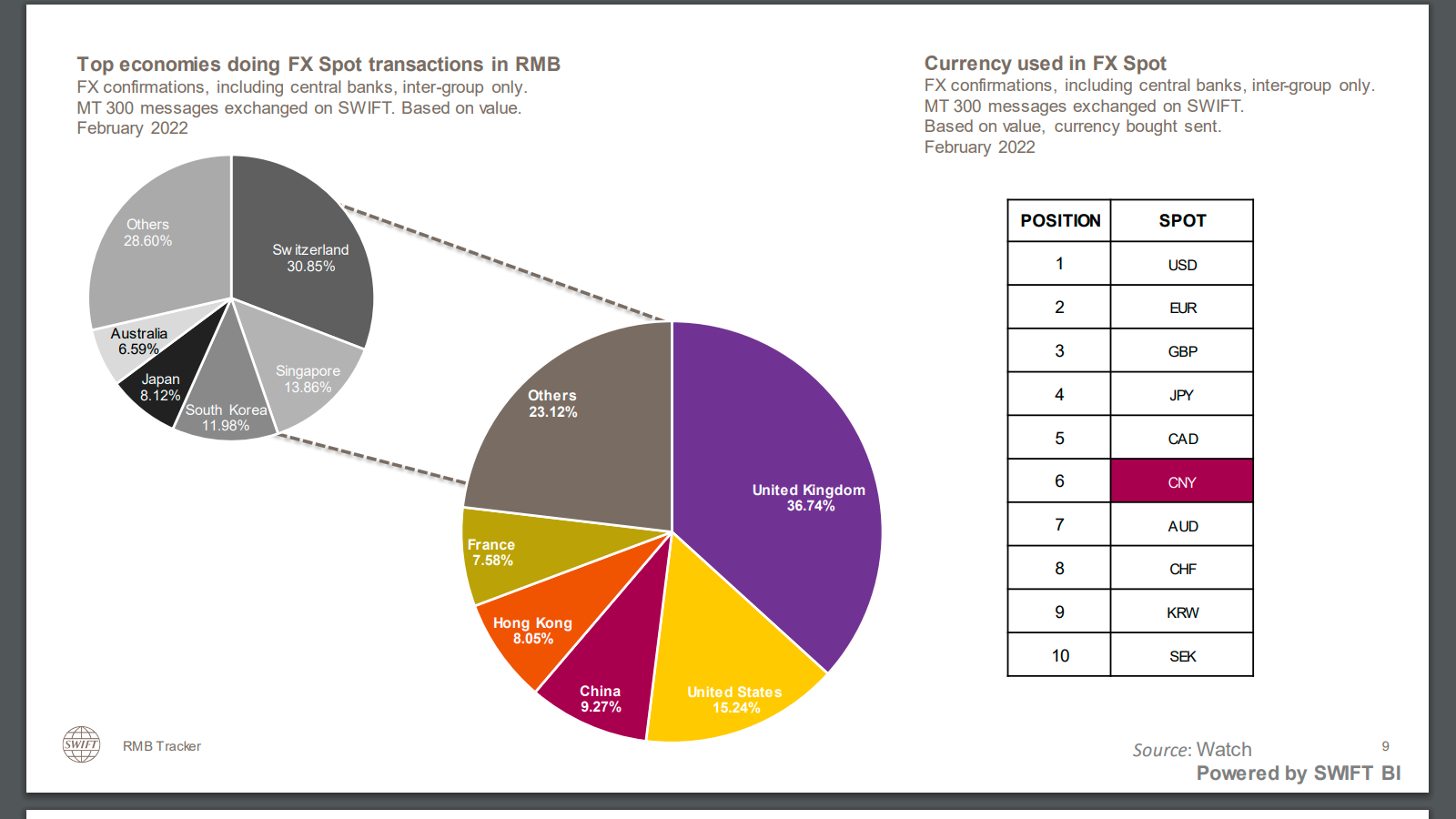

We are going to start with some easy charts. It’s comparing February 2020 to February 2022. Spend a minute on this. Think of it like a financial comic strip.

- As of February 2022, the RMB has dropped one position to the fifth most active currency for global payments by value, with a share of 2.23%

- Overall, RMB payments value decreased by 35.12% compared to January 2022, whilst in general all payments currencies decreased by 6.96%

- In terms of international payments excluding payments within the Eurozone, the RMB ranked 7th with a share of 1.43% in February 2022

- Euro has been very weak but it’s intra-europe trade has been stellar

Internationalizing a currency. It all started in ancient Greece

There are age-old dilemmas of internationalizing a currency (making it desirable for cross broader commerce) and China is encountering all of them.

China has several major issues and we’ll touch on a few biggies”

Competitiveness. When foreigners buy and hold a currency they increase its value. This appreciation persists as long as the buyers hang on to the currency as a store of wealth. A stronger currency hurts a nation’s exports by making its exports more expensive abroad and creates more competition.

Our trade deficit is China’s trade surplus and this means they are holding dollars.

As we saw a few paragraphs above, the U.S. trade deficit is largely the product of a low national savings rate, and this determines the inward and outward flows of funds that affect the value of the dollar and the U.S. trade balance.

When the U.S. can purchase goods from the world market simply by printing money or issuing debt, it is destined to run persistent trade deficits.

Net exports is the country’s trade balance, the simple math is it equals national savings minus investment. Imbalanced trade implies insufficient national savings to finance national investment.

When savings and investment become mismatched, the savings gap becomes negative. Americans don’t save money, Chinese do

China’s economic model relies on boosting exports by keeping its exchange rate undervalued. This requires China’s central bank to purchase large quantities of dollars, reinforcing the dollar’s status as the global reserve currency. China’s continued groth is based on exports and has outsized economic vulnerability if that condition changes.

The renminbi’s status as a reserve currency has been impeded by the Chinese government’s unwillingness to free up its exchange rate, allowing the currency’s external value to be determined by market forces, and to fully open the capital account, further they still maintain a number of constraints such as a rigid interest rate structure.

There is also a very real cultural and ‘People Operating System’,

Chinese leadership is certainly pursuing some contained market-oriented reforms, but for them to advance the yuan would require political, legal, and institutional reforms. And that ain’t happening.

So then, what the heck is China doing. CIPS and the digital currency.

China’s Cross-border Interbank Payments System

This is a technological platform that makes it easier to use the currency for international transactions. This payments system also has the ability to bypass the Western-dominated SWIFT messaging system for international payments. As the renminbi becomes more widely used, other smaller and developing countries that have strong trade and financial links with China might start to invoice and settle their trade transactions directly in that currency. This would likely not be a hit against the dollar, but rather the Euro as that currency is in jeopardy in its use in Africa.

Digital Currency Electronic Payment

DCEP does not improve the renminbi’s role in global finance but could eventually be linked up to the cross-border payments system, further digitizing international payments.

As a reminder from what I wrote, and you read, a few paragraphs above, nothing has yet changed foreign investors’ perception of the renminbi as a reserve currency as that requires significant reforms including to the nucleus of its financial architecture..

China’s government and corporate debt securities markets are very large but have light trading volume and little regulatory frameworks. And so on.

China’s debt in dollars

Foreign debt, almost entirely American dollars invested in Chinese companies puts enormous pressure on the country’s foreign exchange reserves as its repayment obligations come due.

There is about USD $3 trillion of Chinese dollar denominated debt built up by subsidiaries in and outside of China and of that about 70% is guaranteed by entities such as onshore parent companies and their subsidiaries and by secondary repayment obligations.

Much of this debt is short term and requires round after round of refinancing of in some instances over a trillion dollars US dollars.

Chinese companies are inside a dollar vise, crunched to acquire dollars to service their commitments, and this at a time the dollar is hitting multi year highs.

And so on

Chapter 6. Is this Bitcoin’s moment to shine, or tarnish?

Is Bitcoin money?

For regulatory purposes it is not. The IRS and CFTC have defined iit as a commodity, because that is necessary for regulatory purposes.

But – in terms of the conceptual idea, it is money,

But – is not currently a very good one.

I add the caveat YET, this allows its advocates to be right, or wrong, there is a future unknown.

The price is volatile and, as a medium of exchange it is not optimal because if we think the price is going to go down, I don’t want to receive it, and if I think the price is going to go up, I don’t want to spend it.

Will Bitcoin or another cryptocurrency become a successful, privately issued fiat currency?

That would mean being widely accepted, constantly used in payments and settlements, used to denominate debt and other enforceable contracts..

and it would mean people would be going around not asking

- “what is the price of Bitcoin?”, but asking…

- “what is the price of other things in Bitcoin?”

Bitcoin has its own ‘currency supply rule’. There is a fixed and known rule for how the money increases over time and because of this you don’t have to worry that the issuer of the currency will behave irresponsibly, introduce bad monetary policies and/or devalue it.

But – That feature that’s a plus is also its minus. Because of its ‘fixed’ rule and you are not able to provide the currency in a way that might be beneficial in general for an economy or even to compete with the monetary policies of alternative crypto coins or even barter or scrip notes.

For cryptocurrency to mature to the scale that its theorists expect it must go through a transformation.

As a socio-technical trustlessness network it seeks to remove the need for a central control point. But as it’s technology grows, new or unanticipated issues emerge which ultimately require the setting up of a social institution in order to protect or regulate the technology. ‘The absence of rules does not mean the absence of rule breaking”.

Cryptocurrencies, specifically Bitcoin, are managed by a small community of developers without a governance structure to democratically respond to the technical, social, economic, and political implications of the technology.

In a solipsistic, atomized and fragmented world, the chance of reconciling opinions on the political’ness of bitcoin is zero.

Those same features of bitcoin that make it appealing such as its technology or its use as a antistatist currency may be those same features that constrain its actual big dollar and big transaction use

Central Bank stuff

One way of defining liquidity is the ability of an asset to be converted to cash on demand. Another view is that liquidity is determined by the bid-ask spread, and an investment with a lower bid-ask spread has higher liquidity.

Liquidity thus means that there aren’t discounts or premiums attached to an asset during buying or selling, and it is easy to enter and exit the market.

And that’s a bigly problem

- The average turnover in the forex market is about $7 trillion dollars daily

- Bitcoin, at today’s price, around $40,000, and with today’s volume, it has traded only about $40 billion.

Certainly that can be improved, perhaps thru better regulations and crossing the chasm from early’ish adopters to the more risk averse who would be willing to have high frequency transactions with it. Another trading volume gain comes as more exchanges are brought online where it can be traded.

But – those improvements could likely also bring its price down rather than enhance it.

And, with those improvements in pricing an investor could buy $100 billion of it one day, and sell it the next – this is because they are carrying less risk to hold it bitcoin, and they will get paid less for their risk.

Bitcoin injects extra volatility which is counterproductive for countries looking for stability.

Why do countries peg their currency to another currency or have a dollarized economy? It’s because their currency has become too volatile or lost credence in the market and become out of control and very inflationary.

And therein is a battle line disagreement, bitcoin theorists see a future in which it competes as a vehicle currency and as a medium of significant bilateral trade, others theorize the contrary, an even greater monopoly by the central bank through digital money.

There is a use case of bitcoin as a small trade block regional alternative to a reserve currency for small bilateral commerce, that’s an unknown and perhaps will accelerate as the world goes into Great Financial Crisis 2.0 overdrive. It’s a good bet.

There is a not yet time tested application for the sovereign use of bitcoin and crypto

- El Salvador which uses the U.S. dollar as its currency became the first country in the world to pass legislation allowing use of bitcoin in any transaction The hope is that this resolves the issue that relatively few citizens have bank accounts, and this will cut the cost of sending remittances, or money that workers ship back to their families in El Salvador from other countries

- Venezuela. The bolivar-to-bitcoin market has become a useful medium as the dollar-starved nation increasingly seeks the digital token in exchange for its nearly worthless currency. Trading in bitcoin helps Venezuelans access dollars as skyrocketing inflation and a massive depreciation of the bolivar have made businesses often demand foreign currency for nearly everything they offer.

In closing

My preference, if I am allowed one, is to own cash and gold.

Cash has no memory. Neither does gold.

And so on

Chapter 7. The dollar is up, food prices are up and ‘you should see the other guy’

We’re gonna discuss the strength of the dollar and also its weakness. Everything that’s very good also is a little bad, and vice versa

The dollar (.DXY) is measured on an index against a basket of six major currencies. In 2021 it gained nearly 7% against major currencies and in 2022, 4 months in, it has gained another 5%.

Currencies are traded on the foreign exchange (“FOREX”) market.

Most countries, like the U.S have a flexible exchange rate and allow FOREX trading to determine the value of their currencies. It is floating and the market decides the price

Alternatively, many countries will use a “dollar peg”. This is when a country maintains its currency’s value at a fixed exchange rate to the U.S. dollar. The country’s central bank controls the value of its currency so that it rises and falls along with the dollar.

- 66 countries either peg their currency to the dollar or use the dollar as their legal tender

- 25 countries peg their currency to the euro and the 19 eurozone members use it as their currency

- Many countries also have hybrids currency models, dual currencies and other mischievous ways of ‘money stuff’

The value of one currency against another is in large part a function of central bank policies in each country.

- If a central bank pursues loose policy — low interest rates that increase the risk of inflation — a currency will fall in value relative to the currencies of its trading partners.

- When a central bank tightens policy — raises interest rates — then the currency generally strengthens.

One reason for the dollar’s strength lately is the expectation that the U.S. Federal Reserve will begin raising interest rates fairly soon as the U.S. economic recovery gains. Then question then becomes: How will a stronger dollar affect America’s economy?

The rest of the World

For the most part the devastating inflation that is ravaging much of the world has a more muted affect here, at least so far. Gas prices are high, but they are higher ‘over there’, same with food prices and so on.

A high value of the dollar is a massive tax on U.S. exports and a huge subsidy to U.S. imports. It’s a big bounty for foreign countries to dump their products on U.S markets at deep artificial discounts. Although there are many reasons for the dollar’s recent rise we should get some context by going backwards because the past is happening again.

In the late 1990s the United States was booming, inflation was low and economic growth was high. At the same time Japan had continuing stagnation, continental Europe had slow growth and high unemployment, the Asian financial crisis was ripping, and there were financial turmoils in other countries from Russia to Argentina. All this led to a massive flight of capital funds out of those countries and into the one “safe haven” in the global economy: the United States.

Let’s look at some of that in greater detail, the overall impact of U.S. economic strength relative to foreign economic weakness.

Japan…

Intervened, both in its own central bank operations and in concert with other exporting countries that relied on currency warfare, to halt the dollar’s previous decline by increasing their purchases of U.S. government securities, propping up the value of the dollar and preventing their own currencies from appreciating further, they made the japanese Yen less appealing to invoice in and to hold in central banks.

It was these interventions that effectively started the dollar on a new, never ending upward course and contributed significantly to rising U.S. trade deficits at that time. It’s never looked back, the trade deficits keep on growing.

Foreign countries’ fiscal policy decisions were to block exchange rate adjustments and preserve their protectionist trade policies and the reliance on export-led growth.

The rise, and the role of the US dollar was not in itself due to any “strong dollar” policy. The US has little meaningful exchange rate policy and cannot implement one given an independent Federal Reserve targeting inflation. The ability of policymakers to set an exchange rate independently of market forces for extended periods of time is limited. To accommodate short term dollar movements, the Treasury can intervene in foreign exchange markets and weaken the currency.

Its main tool is the Exchange Stabilization Fund, which is operated by the Treasury which can use the fund’s assets to buy foreign currencies in the open market, boosting their value against the dollar.

The Fed has traditionally matched Treasury intervention funds, thus doubling the Treasury’s firepower. In principle, the Fed could also expand its balance sheet beyond that to buy foreign assets, and other countries could agree to join the United States in an intervention to lower the dollar.

One way to conceptually understand one result of an asymmetrical currency war is that these countries effectively exported unemployment to the U.S.

A higher dollar brings down import prices and forces domestic firms that compete with imports to either cut price-cost margins and/or lose sales volume.

- There are indirect effects of dollar appreciation on investment through the reduced profits of domestic manufacturing firms. Business firms rely on the cash flow out of current profits to finance investment, either internally (through retained earnings) or by attracting outside funds. Reduced profits curtail the ability of firms to finance their investment and can result in the cancellation or delay of already planned capital expenditures.

Let’s move to the other side of the dollar.

Depreciation of Emerging Market currencies against the US dollar raises that burden associated with a higher share of foreign-currency-denominated debt obligations, this frequently leads to a dollar denomimated debt crunch, countries and businesses have to repay loans, but their currencies have gone down in value and the US dollar has gone up.

Most emerging market currencies are being hammered against the dollar, and it’s going to be more hammering as the Federal Reserve finally delivers expected aggressive policy “tightening”

Food and Stuffs

Consumers in emerging market countries will suffer more pronounced effects of inflation and food scarcity as they experience even higher increases due to the higher dependency on food imports, already a crisis in countries in sub-Saharan Africa, the Middle East and North Africa.

Emerging markets and low-income countries are also more vulnerable to food price shocks because consumers in these countries spend a relatively large proportion of their income on food.

While their people are starving, the currency depreciation against the US dollar is made worse by falling export and tourism revenues and net capital outflows.

Back in America

The dollar being high can be good for short durations to allow Americans to smooth economic shocks that can have enormous ripples, however this has been a 40 year assault to make the dollar high. Short term good, but long term bad. it will help us dampen the effects of inflation, but it’s not free.

And so on