Is bitcoin going to $1 million dollars within 90 days of March 19th, 2023?

Table of Contents

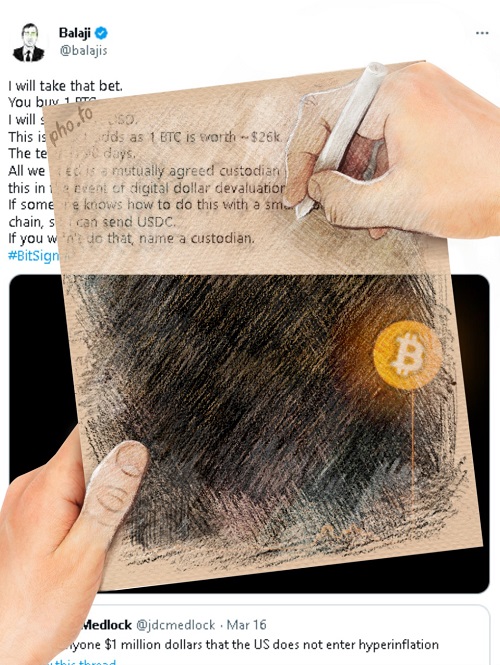

The Balaji Bitcoin Bet

On March 19th 2023 Balaji Srinivasan tweeted a wager that bitcoin will be at $1 million dollars within 90 days.

“I will take that bet.

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.“

Technological mysticism

Let’s reverse engineer Balaji’s wager using the scalpels of Karl Popper‘ scientific mechanics of ‘true‘ and George Soros’ Theory of Reflexivity.

Karl Popper

Popper was impressed by the asymmetry between trying to prove a theory and trying to refute it.

A theory is a universal statement that makes a claim about a large, perhaps infinite, number of events. Consequently, any number of confirmations are insufficient to prove its validity. At the same time, just one event that contradicts the theory is sufficient to refute it.

“My proposal is based upon an asymmetry between verifiability and falsifiability; an asymmetry which results from the logical form of universal statements. For these are never derivable from singular statements, but can be contradicted by singular statements.

Consequently it is possible by means of purely deductive inferences…to argue from the truth of singular statements to the falsity of universal statements.”

“The discovery of a theory is now only the first stage. The theory is accepted provisionally, and it is in the next stage that the most important work is done: attempting to refute the theory by subjecting it to severe tests.”

Is proof, proof

- We start with a hypothesis, deduce testable predictions from it, and observe whether the predictions are true or not. If the predictions are false, we conclude the hypothesis is false.

- On the method of hypothesis, verified predictions increase the probability that the hypothesis is true. According to Popper, verified predictions are no reason to believe the hypothesis is true or even probable.

Bitcoin and the Theory of Reflexivity

George Soros profoundly expands on Popper with his Theory of Reflexivity which applies the behavioral sciences to economics, as well as to the social environment.

Soros asserts that momentum, trend and reality never have to collide: a bubble can exist atop another bubble which exists atop more bubbles and so on and so on, forever.

Perfect knowledge

It seems everybody has imperfect information? Does the market ever converge around the view of bitcoin as a durable currency, past its convenience, speculation and novelty?

Is bitcoin mining alchemy?

Does Bitcoin have the drivers of credit, leverage and debt that can be resilient to volatility and sharp selloffs? I dunno.

Bitcoin has been an excellent laboratory but it now competes with equities that have data that is well recorded and well preserved and widely accessible and understandable analysis.

There is an asymmetry of information that makes it hard for a new entrant. It’s like walking into a theater when the sci-fi movie is half over.

A person coming in to buy has little insight as to whether the entry point is somewhere within a positive self reinforcing loop and has therefore been mispriced.

Theory of Reflexivity + Karl Popper:

Trends tend to validate themselves. Trends can be a valid strategy that can defeat a rational market. But there is always a point when you don’t want to be a trend follower. Reflexivity is that false views cause wrong actions.

The intricacies of the bitcoin environment seem to have more complexity than an investor can easily comprehend, and this creates another pricing distortion.

Positive feedback process is self reinforcing but eventually the participants’ views would become so far removed from objective reality that the participant would have to realize them as unrealistic. In this state it’s “disequilibrium” or “far from equilibrium.”

Bitcoin participants can’t possibly base their decisions on “knowledge“, because that anticipates the future and the future is contingent on decisions people have not yet made. What those decisions are going to be and what effect they will have can’t be accurately anticipated.

Will bitcoin go to $1 million in another 88 days? Unlikely, but maybe.

The End?