note: on 12 22 2022 I changed the title of this post, its meta description and made the font 14 and added this note.. Nothing in the body was changed, not even my bad writing. Wayback machine snapshot from 2014 is here (look at my old blog design, lol)

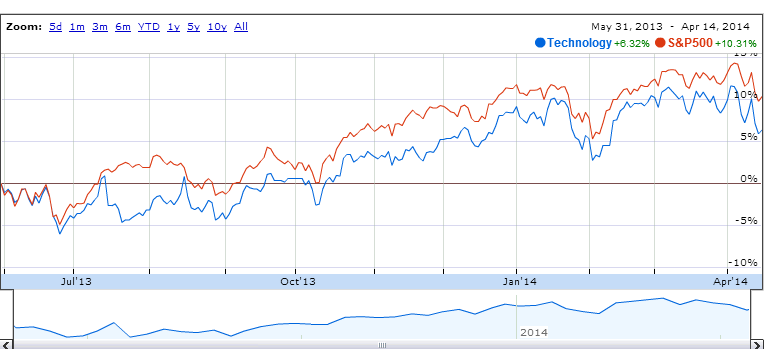

I have been deep into an irregular review of my investments over the past few days. It is my response to stock market volatility in tech and SaaS.

“There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don’t know. But there are also unknown unknowns. There are things we don’t know we don’t know.” Donald Rumsfeld

The uncertainty has me reasoning aloud this simple part of my strategy and its forensics:

- There is no reliable indicator, or even any combination of instances that point anywhere but a continuation of capital looking for growth.

- I do not think we are in a ‘bubble’. That is a cruel term that infers inefficiency in pricing,

- Will there be a return to a higher interest rate environment and will it telegraph its intention before its arrival? And…

- What is the residual effect (on my portfolio) if the stock market continues to deteriorate and trend lower?

Table of Contents

Tech indigestion

Possibly the most cautionary signal is that stock market sell-offs (and stock pops) in technology companies are indiscriminate, everything rises and falls together. Nothing is moving in a way that is extraordinary and outside an index. In a more mature and ‘true’ correction there should be a flight to the quality names. Instead, this is a net sell and a stock redistribution out of unsure hands and into unsure hands.

Rebalancing a portfolio in this environment is treacherous. Each rung has a unique station on a complete, large ladder.

- I’m not happy to sell into this market because I suspect that certain stocks I will be buying back at higher prices, when its dust has settled.

- I’m not happy to hold certain stocks because it challenges both my risk tolerance and my endurance.

- I’m hesitant to buy anything. Going forward there may be (many more) stocks that are orphaned by losing investor visibility and analyst neglect.

“The recovery in profitability has been amazing following the reorganization, leaving Barings to conclude that it was not actually terribly difficult to make money in the securities markets.” Peter Baring in the months before the collapse of his bank.

Will ripples from the stock market squeeze the secondary and tertiary VC firms?

VC (and seed stage) firms are now mostly participating in a syndicate. However, if capital becomes scarcer, syndicate members with less credit worthiness will be challenged and this invites a new breed of tail end funds and cherry picking when desperate cash calls are unanswered.

- Is ‘C’ paper being stuffed into an ‘A’ wrapper?

- We may be entering a market that becomes more selective in evaluating worthiness and this favors the tier 1 VC firms. The best and biggest firms get better and bigger.

I expect that the stock market begins to act rationally and shares of leading tech companies find a good, appreciative, home and this cycle of buying growth is extended.

Markets need a safe haven and those tech companies with the best management, analyst confidence, track records of quarterly improving performance and operating leverage are rewarded with higher premiums.

My picks are Facebook and Tesla.

(note I would include Google but I have held that for so many years and don’t want to tamper with my cost basis)

These are the bets I have made over the last few days. If the market turns north, I expect they will recover more vigorously and sustained than their peers and regain investor confidence.

My quick, ‘kinda’ free association thoughts:

Tesla

- Tesla has less risk now that they have built up partners, manufacturing, and an infrastructure that is durable. Early shareholders had considerable more risk and they were paid for it.

- Tesla is creating a complete system that creates value at every point.

- It is priced to perfection on its auto business if that stood alone. Is this an auto company or is it a ‘green’ company that sells cars and is building the last mile for clean energy

- Linear models and forecasts don’t work for Tesla. Tesla will grow exponentially.

- Availability of favorable debt to fund massive growth. They have the top line to service debt.

- Tesla owns the entire customer experience. The auto industry is not fully recognizing the threat of its new entrant and they are not trying to neutralize it. They seem to be happy to try and advertise them out of business.

FB:

- I am a huge fan of the Oculus rift. If you haven’t tried it, you should.

- Facebook bought an unlimited amount of real estate and they will be greedy landlords.

- 2 billion dollars has never been so cheap

But.Markets.Are.Churning.And(for right now)…Cash is king

We have not seen a 10% drop in some time and we may be heading there. Sometimes cheap can get cheaper…