I had written in an earlier post about social capital. It was kept with the narrow framework of the ‘gig economy’ and, even more narrowly, that new mechanisms will be needed to score creditworthiness, underwrite loans, price and service. It broadly covered a theory of an algorithm less reliant on history and more dependent on the innovations in the predictions markets applied into an individual’s future earnings.

The gig worker will need significantly more money than the accessibility and constraining features of payday loans provides; because of their earnings volatility a new product type is needed to smooth consumption and/or earnings shocks.

Table of Contents

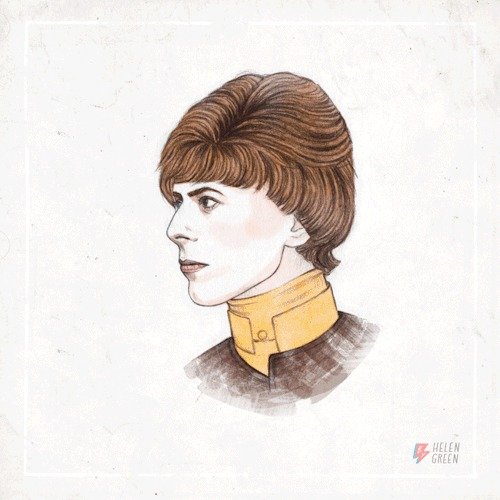

Bowie bonds

The first crude instance is in late 1996, investment banker David Pullman negotiated with David Bowie and his business manager, William Zysblat to issue private securities backed by the future revenue of 25 of Bowie’s albums recorded before 1990. The $55 million “Bowie Bonds” issue was privately sold to Prudential with a ten year maturity and was paid off in full at maturity in 2007. From that start we can move forward with newer constructs, same theory…

Human Equity

Income Share Agreements (“ISAs”) enable an individual to raise funds by pledging a percentage of their future earnings to investors for a certain number of years

Upstart

Upstart introduced a transaction that allowed potential investors to invest in individuals seeking funds for business or education costs. This model was available until May 6, 2014, when it was discontinued in favor of more traditional loan products, due in part to regulatory uncertainties.

However, agreements entered into between Upstart and funding recipients prior to May 6, 2014, remain in effect. In return for an upfront cash investment in the funding recipient, investors earned a specified percentage of the funding recipient’s earnings for a set term, typically five years.

The contract was an agreement between Upstart (as a middleman) and the funding recipient, under which the recipient agreed to pay the investor (indirectly) the agreed percentage of recipient’s total annual income as reported on their tax return (Line 22 of Form 1040) over the specified term. Significantly, Line 22 includes not only wages and business income but also interest, dividends, alimony, and lottery winnings.

The risk to the investors was partially mitigated by the funding agreement deferral provision, which deferred the annual payments and added a year to the contract term if the recipient’s income for the year fell below a pre-established threshold.

A funding recipient could obtain up to five such deferrals, after which they are obligated to pay the income share for the remainder of the now-extended contract term.

The “risk” of the recipient’s extraordinary success was capped by limiting the total income payment to three times the amount of funding received.

Pave

Pave is another startup that commenced offering ISAs in 2012.

Pave’s strategy (as of May 2016) is to target millennials and “high potential individuals” seeking funding for a variety of purposes, including to pay off student loans, to finance education, or to pursue entrepreneurial ventures. The transaction allows funding seekers (“Talent”) to obtain funding by promising to pay investors (“Backers”) a fixed percentage (no more than ten percent) of their annual Line 22 total income over a specified term, which may not exceed ten years. However, unlike Upstart, the Pave arrangement is “peer-to-peer.” The average amount raised is $20,000.44 If Talent’s income falls below 150 percent of the poverty line, repayment obligations are waived, and the payment term is not extended.

Pave’s transaction resembles Upstart but there are structural differences between them. In August 2014, Pave announced that it would be piloting a new loan product.

ISA

Inherent in the ISA model is the need for the investor to predict reliability of returns, made murky by the Equal Credit Opportunity Act (ECOA), particularly those provisions relating to the disparate treatment of protected classes of individuals.

The challenges to ISA investors are twofold. In addition to the underwriting criteria challenges, it is unclear how courts will treat ISAs and whether ISAs will be treated as debt or equity for purposes of a variety of statutes, including the ECOA.

The hybrid. An ISA is many things…

Upstart characterized its arrangement as essentially a loan in its transaction documents. I do not know if this was ever legally challenged, clearly there is some uncertainty as to how they should be regulated under securities, bankruptcy, contract, tax, and consumer protection laws.

- Debt characterization typically leads to the normative conclusion that, despite their distinctive marketing, ISAs are not special. The corresponding regulatory conclusion is that, because debt is a familiar form of individual financing that falls under well-developed regulatory regimes, few or no new regulatory structures are needed to govern ISAs. There are clear similarities between ISAs and debt, and some ISAs may look so much like debt that they are economically indistinguishable

- A frequently heard claim is that ISAs resemble corporate equity, and I would suppose, sans lawyer, that is a de facto incorporation of humans.

- Some ISAs may resemble insurance or risk-pooling arrangements

Someone in some company somewhere will decode how to do it profitably, sustainably and help define its regulatory definition and governance.

The End?